Dusted off an anecdote from 2018 about trading, investing, and the illusion of certainty. Back after Easter with full wknd notes. All the very best, E

Week-in-Review: Mon: Nikkei reports BOJ will end NIRP and YCC at today’s meeting, add’l Ukraine drone strikes on Russian oil refineries pushes oil above recent range, Putin wins presidential election with 87% of the vote / warned against a direct conflict with NATO, NVDA reveals new chip (as expected) during its much anticipated GTC conference, Apple in talks to incorporate Google’s Gemini AI engine into iPhone, Trump says he’d impose 100% tariff on Chinese autos made in Mexico, ECB’s de Cos sees June cut, China IP YTD 7.0% (5.2%e) / Ret sales YTD 5.5% (5.6%e), Japan machine orders -10.9% (-10.5%e), Brazil eco activity 3.45% (3.7%e), US NAHB housing mkt index 51 (48e), S&P +0.6%; Tue: BOJ largely as exp / hikes rates to 0-0.1% / scraps YCC / abandons ETF purchases / maintains JGB purchases / no fwd guidance, RBA unch as exp / scraps mildly hawkish stance, S&P raises Egypt’s credit outlook to positive, N. Zealand treasury says economy is under severe economic slowdown, China regulator accuses Evergrande of $78b fraud, Germany ZEW exp 31.7 (20.5e) / current situation -80.5 (-88.2e), US Housing starts 1521k (1440k e) / Building permits 1518k (1496k e), Canada CPI 2.8% (3.1%e) / Median Core 3.1% (3.3%e), Navy men’s lacrosse loses to Villanova 14-7, S&P +0.6%; Wed: Fed unch as exp / Raises GDP and PCE forecasts but maintains median dot at 3 cuts for 2024 / 2026 dots show one less cut and LT dots show marginal increase / Powell dovish during press conference, Nikkei reports that BOJ is weighing further hikes this year, BCB cuts 50bp / signals could slow easing pace if necessary, Czech CB cut 50bp as exp, Indonesia CB unch as exp, Germany PPI -3.8% (-4.1%e), UK CPI 3.5% (3.4%e) / Core 4.5% (4.6%e) / RPI 4.5% (4.4%e), S. Africa CPI 5.6% (5.5%e) / Core 5.0% (4.9%e), EU cons conf -14.9 (-15.0e), Argentina 4Q GDP -1.4% (-1.5%e), S&P +0.9%; Thu: SNB surprises with 25bp cut (no chg exp), CBRT surprises with 500bp hike (no chg exp), BOE unch as exp but strikes dovish tone as 2 hawks voted for unch (vs hikes previously) and Gov Bailey suggests don’t have to wait for infl target to be reached to cut rates, Mexico CB begins cutting cycle with 25bp cut as exp, Taiwan CB surprises with 12.5bp hike (unch exp), Norges bank unch as exp, DOJ sues Apple for breaking antitrust laws, China / Russia reach agreement with Houthis to allow their ships to sail through the Red Sea, N Zealand 4Q GDP -0.3% (0.0%e), Aussie employ change 116.k (40.0k e) / unemp rate 3.7% (4.0%e), UK Public borrowing 8.4b (6b exp), EU flash PMI mfg 45.7 (47.0e) / serv 51.1 (50.5e) / comp 49.9 (49.7e), UK PMI mfg 49.9 (47.8e) / serv 53.4 (53.8e) / comp 52.9 (53.1e), Mexico ret sales -0.8% (1.2%e), US Init claims 210k (213k e), US flash PMIs mfg 52.5 (51.8e) / serv 51.7 (52e) / comp 52.2 as exp, US leading index 0.1% MoM (-0.1%e), S&P +0.3%; Fri: China relaxes grip on ccy as fixing weakness instigates sharpest ccy sell off in months / PBOC deputy gov says there is still room for RRR cuts, Columbia CB cuts 50bp as exp, Russia continues with the largest attack on Ukrainian energy infrastructure since the war began, Fed’s Bostic now sees just 1 cut later this year, Apple in talks to use Baidu AI tech in China devices, Japan CPI 2.8% (2.9%e) / Core 3.2% (3.3%e), UK cons conf -21 (-19e), Germany IFO 87.8 (86e), S&P -0.1%; Sat: Navy men’s lacrosse beats Holy Cross 17-7.

Weekly Close: S&P 500 +2.3% and VIX -1.35 at +13.06. Nikkei +5.6%, Shanghai -0.2%, Euro Stoxx +1.0%, Bovespa +0.2%, MSCI World +1.9%, and MSCI Emerging +0.4%. USD rose +10.9% vs Ethereum, +7.4% vs Bitcoin, +4.2% vs Chile, +2.0% vs Sweden, +1.6% vs Yen, +1.4% vs South Africa, +1.2% vs Indonesia, +1.1% vs Sterling, +0.7% vs Euro, +0.7% vs Australia, +0.6% vs India, +0.5% vs Canada, +0.4% vs China, +0.3% vs Mexico, and +0.1% vs Brazil. USD fell -0.3% vs Turkey, and -0.2% vs Russia. Gold -0.1%, Silver -2.1%, Oil +0.1%, Copper -2.8%, Iron Ore +4.5%, Corn +0.6%. 10yr Inflation Breakevens (EU -1bps at 2.04%, US +3bps at 2.35%, JP +6bps at 1.28%, and UK +4bps at 3.65%). 2yr Notes -14bps at 4.59% and 10yr Notes -11bps at 4.20%.

2024 Year-to-Date Close: Argentina +24.9% priced in US dollars (+32% priced in pesos), Denmark +14.7% priced in US dollars (+17.5% priced in krone), Japan +13.6% in dollars (+22.2% in yen), Turkey +12.5% (+22%), Italy +10.5% (+13.2%), Colombia +10% (+11.2%), Ireland +10% (+12.6%), S&P 500 +9.7% in dollars, NASDAQ +9.4% in dollars, Netherlands +8.8% (+11.4%), Euro Stoxx 50 +8.7% (+11.3%), MSCI World +8.2% in dollars, Taiwan +7.9% (+12.8%), Greece +7.6% (+10.2%), Saudi Arabia +7.2% (+7.3%), Israel +6.9% (+7.3%), Germany +6.1% (+8.7%), Spain +5.8% (+8.3%), France +5.6% (+8.1%), Philippines +4.8% (+6.7%), Malaysia +2.8% (+6%), Russia +2.5% (+5.6%), Russell +2.2% in dollars, Canada +1.8% (+4.9%), Poland +1.4% (+3.2%), Hungary +1.3% (+7.6%), India +1.3% (+1.7%), UK +1.2% (+2.6%), China +0.6% (+2.5%), Sweden +0.4% (+5.8%), Czech Republic +0.3% (+5.4%), Belgium +0.2% (+2.6%), Mexico -0.3% (-1.4%), Austria -0.5% (+1.9%), Korea -0.8% (+3.5%), Indonesia -1.7% (+1.1%), Switzerland -2.3% (+4.6%), Australia -2.4% (+2.4%), UAE -2.7% (-2.7%), Singapore -3% (-0.7%), Norway -3.3% (+2.8%), HK -3.3% (-3.2%), New Zealand -3.8% (+1.8%), Chile -5.6% (+5.1%), Finland -5.7% (-3.4%), Brazil -8% (-5.3%), Thailand -8.4% (-2.5%), South Africa -8.7% (-4.9%), Venezuela -13.1% (-12%), Portugal -14.1% (-12%).

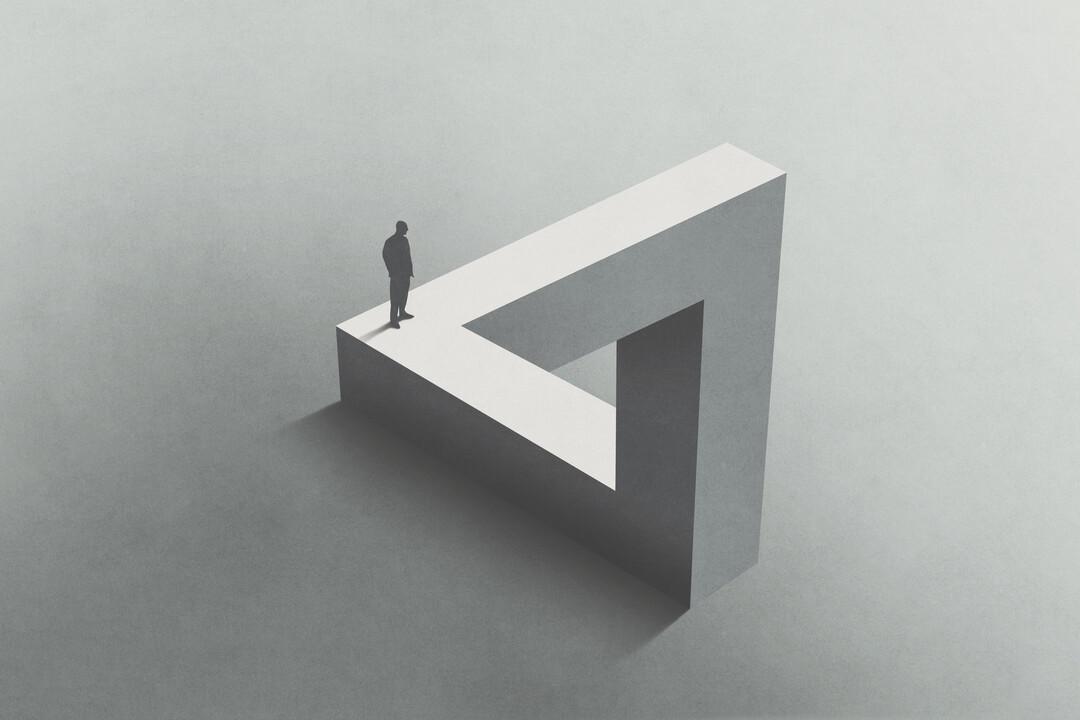

Anecdote (Nov 2018): “Why do people feel that to be a good leader, they must absolutely believe in one direction over another, one path over another, one person over another?” asked the investor, an allocator. “Why do most people feel they have to live in a world of absolutes?” We were discussing the illusion of certainty. “We live in a world filled with questions. And the best traders I’ve known have never been sure of anything.” The blessing and curse of this business is that it forces us to come to terms with how little we know. It is at once terribly humbling and awe inspiring, in that to maintain your balance you must continually seek to define a wide range of possible outcomes, possibilities. Which is an exciting journey, requiring imagination, and a recognition that world history is the story of chance, surprise. “The most successful traders speak in probabilities of one thing over another. Not one dares pound the table and state something with absolute certainty.” I have friends who can change their minds twice in the same sentence. They’re the survivors. In their wake are those who needed to be right. “Something in our nature, or perhaps society, leads us to believe that to have gravitas we need to make grand pronouncements, appear definitive. Such statements are almost always wrong.” Yet we continue to listen, in a hopeless pursuit of certainty. “The best leaders amongst us seem to understand that their gift is not in pointing the way, it’s in taking input, maintaining flexibility, openness, adjusting enroute,” he said. “And as a trader, your job is to figure out what others will do because of their political and financial orientation, in a world that is unknowable, forever changing, and then make money with that.”

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.