The Iranian attack on Israel appeared as an iPhone price alert well before any news service would run the story. That’s how markets work. Crypto is the only liquid asset class that trades on Saturday, so those of us who never really turn off learned something big happened right around 3:45pm ET on Saturday. Bitcoin dumped from $67,000 to $61,750 in a matter of minutes. Had the S&P 500 been open, it would’ve gapped lower by 3.0% give or take, in my estimation. Probably not enough to seriously stress the stop-loss mechanisms at all those grossly overleveraged multi-manager pod shops, but a reminder that markets are continuous until they are not. And anyway, by the time of the S&P futures market open on Sunday night at 6pm ET, and then the liquid cash market open at 9:30am ET Monday, we’ll know a lot more, and prices will reflect the new information. The Iranian regime posted this on X at 6:06pm ET, well after it initiated hostilities: Conducted on the strength of Article 51 of the UN Charter pertaining to legitimate defense, Iran’s military action was in response to the Zionist regime’s aggression against our diplomatic premises in Damascus. The matter can be deemed concluded. However, should the Israeli regime make another mistake, Iran’s response will be considerably more severe. It is a conflict between Iran and the rogue Israeli regime, from which the U.S. MUST STAY AWAY! --- Crypto traders appeared to take some comfort in the Iranian sentence: “The matter can be deemed concluded.” Bitcoin prices bounced off the bottom. And while Israeli sources indicated they intercepted 99% of the incoming drones and missiles, they also suggested the Iranian attack requires a decisive response. G7 countries planned a call for Sunday to coordinate a response. Biden pledged to stand by Israel. The US Navy sent an amphibious warship to the Eastern Mediterranean with 2,500 young Marines. And those of us, many thousands of miles from the region, prayed that we restore a semblance of balance, stability, peace, through greater internal political cooperation at home, principled diplomacy abroad, and overwhelming economic and military strength.

Week-in-Review: Mon: Israel says progress has been made in cease-fire negotiations, TSLA rises following Musk’s weekend tweet about upcoming robotaxi launch, Yellen says US has taken “major steps” to stabilize relations with China, US gov’t to give TSMC $6.6b in grants to ramp up production in US, Trump says states should set the limits on abortion, IAEA warned that the Russian occupied Zaporizhia power plant in Ukraine came quite close to accident when it was attacked by drones on Sunday, Israel CB unch (~half of forecasters expected a cut), Riksbank’s Theeden is cautious on easing due to concerns about weak SEK, Turkey IP 11.5% (8.1%e), Japan Labor cash earnings 1.8% as exp / real -1.3% (-1.4%e), Germany IP -4.9% (-6.8%e), US NY Fed 1y infl exp 3% (3.04%p), S&P flat; Tue: Former Fed member Bullard is expecting 3 cuts this year, Yellen concludes China trip with warning of sanctions for supporting Russia, loan demand in Europe falls sharply, Turkey announced restrictions on expts to Israel after it opposed Turkey’s plan for air dropping aide into Gaza, rumors that BOJ set to raise infl forecast at next meeting, Japan Machine tool orders -3.8% (-8%p), US NFIB 88.5 (89.9e), Mexico CPI 4.42% (4.50%e) / Core 4.55% (4.63%e), S&P +0.1%; Wed: US CPI 3.5% (3.4%e) / Core 3.8% (3.7%e), BOC unch as exp, Fitch downgrades China outlook to negative, US warns that Iranian missile or drone attack on Israel may be imminent, BOJ’s Ueda says undesirable to hold large volume of bonds over long term, AZ supreme court reinstates a near total ban on abortions, FOMC mins suggest tapering to begin soon / highlights supply side improvements to the economy, Japan PPI 0.8% as exp, Brazil IPCA infl 3.93% (4.01%e), Russia CPI 7.72 (7.70%e), S&P -1.0%; Thu: ECB unch as exp / keeps June cut on the table, Nat Gas prices jump following a Russian attack on 2 Ukrainian underground storage facilities / missile barrage destroyed Kyiv region’s largest power plant, MOF’s Kanda says will respond appropriately to any excessive ccy moves, PBOC continues to fix renminbi at stable level despite strong USD following CPI, China CPI 0.1% (0.4%e) / PPI -2.8% as exp, Brazil Ret sales 8.2% (3.7%e), Mexico IP NSA 3.3% (3.1%e), US PPI 2.1% (2.2%e) / core PPI 2.4% (2.3%e), US Initial claims 211k (215k e) / Cont claims 1817k (1800k e), S&P +0.7%; Fri: Israel braced for Iranian retaliation sometime over next 48h / Hezbollah launches 40 rockets and multiple drone attacks, US & UK impose sanction on use of Russian metals on exchanges (ie LME), Fed’s Collins sees only 2 cuts this yr, JPM / WF earnings disappoint in kickoff to earnings season, Biden to cancel $7b in student debt, China instructed its largest telecom carriers to phase out the use of foreign chips by 2027, Bernanke recommends BOE publish its own UK rates outlook and abandon ‘fan’ charts, Japan FinMin Suzuki reiterated his readiness to act on excessive FX moves, IEA cuts demand forecast by 130k barrels, Germany CPI 2.3% as exp, UK IP 1.4% (0.6%e) / mfg prod 2.7% (2.1%e), France CPI 2.4% as exp, China expts -7.5% (-1.9%e) / impts -1.9% (1.0%e) / trade balance $58.55b ($69.10b e), China M2 8.3% (8.7%e), India CPI 4.85% (4.90%e) / IP 5.7% (6.0%e), US impt prices 0.4% (0.3%e), US Mich. Sent 77.9 (79.0e) / 1y infl exp 3.1% (2.9%e) / 5-10y infl exp 3% (2.8%e), Argentina CPI 287.90% (291.80%e), S&P -1.5%; Sat: Iran attacks Israel with hundreds of drones and missiles.

Weekly Close: S&P 500 -1.6% and VIX +1.28 at +17.31. Nikkei +1.4%, Shanghai -1.6%, Euro Stoxx -0.3%, Bovespa -0.7%, MSCI World -1.5%, and MSCI Emerging -0.4%. USD rose +2.3% vs Sweden, +2.1% vs Chile, +1.8% vs Euro, +1.7% vs Australia, +1.5% vs Sterling, +1.4% vs Canada, +1.2% vs Mexico, +1.1% vs Yen, +1.0% vs Brazil, +1.0% vs Russia, +1.0% vs Turkey, +0.9% vs South Africa, +0.2% vs India, and +0.1% vs China. USD fell -4.4% vs Ethereum, -2.5% vs Bitcoin, and flat vs Indonesia. Gold +1.2%, Silver +3.0%, Oil -1.4%, Copper +0.5%, Iron Ore +0.0%, Corn +0.1%. 10yr Inflation Breakevens (EU +4bps at 2.14%, US +2bps at 2.40%, JP +7bps at 1.48%, and UK +4bps at 3.75%). 2yr Notes +15bps at 4.90% and 10yr Notes +12bps at 4.52%.

2024 Year-to-Date Close: Argentina +24.9% priced in US dollars (+33.9% priced in pesos), Turkey +20.3% priced in US dollars (+31.4% priced in lira), Colombia +16% priced in dollars (+16.4% in pesos), Denmark +11.4% (+15.9%), Taiwan +9.6% (+15.6%), Japan +8.6% (+18.1%), Ireland +8.6% (+12.9%), Netherlands +8% (+12.3%), NASDAQ +7.8% in dollars, S&P 500 +7.4% in dollars, Italy +7% (+11.2%), Russia +7% (+11.5%), Saudi Arabia +6.1% (+6.2%), MSCI World +5.7% in dollars, Euro Stoxx 50 +5.4% (+9.6%), Venezuela +4.6% (+5.9%), Greece +4.2% (+8.3%), Hungary +3.9% (+11%), Czech Republic +3.4% (+10.3%), India +3.2% (+3.6%), Poland +3% (+5.6%), Germany +3% (+7%), Malaysia +2.6% (+6.6%), France +2.1% (+6.2%), Spain +1.7% (+5.8%), Philippines +1% (+3.2%), UK +0.8% (+3.4%), Mexico +0.2% (-1.4%), Canada +0.2% (+4.5%), Norway +0.1% (+7.9%), Belgium -0.1% (+3.8%), China -0.4% (+1.5%), Austria -0.5% (+3.5%), Israel -0.9% (+3.5%), Russell -1.2% in dollars, HK -2.2% (-1.9%), Indonesia -2.9% (+0.2%), Australia -3% (+2.6%), UAE -3.5% (-3.6%), Sweden -3.6% (+4.6%), Chile -3.7% (+5.9%), Singapore -3.8% (-0.7%), New Zealand -5.1% (+1.4%), South Africa -5.2% (-1.8%), Finland -5.7% (-1.9%), Switzerland -6% (+2.2%), Korea -6.1% (+1%), Thailand -7.8% (-1.4%), Brazil -11.2% (-6.1%), Portugal -14% (-10.6%).

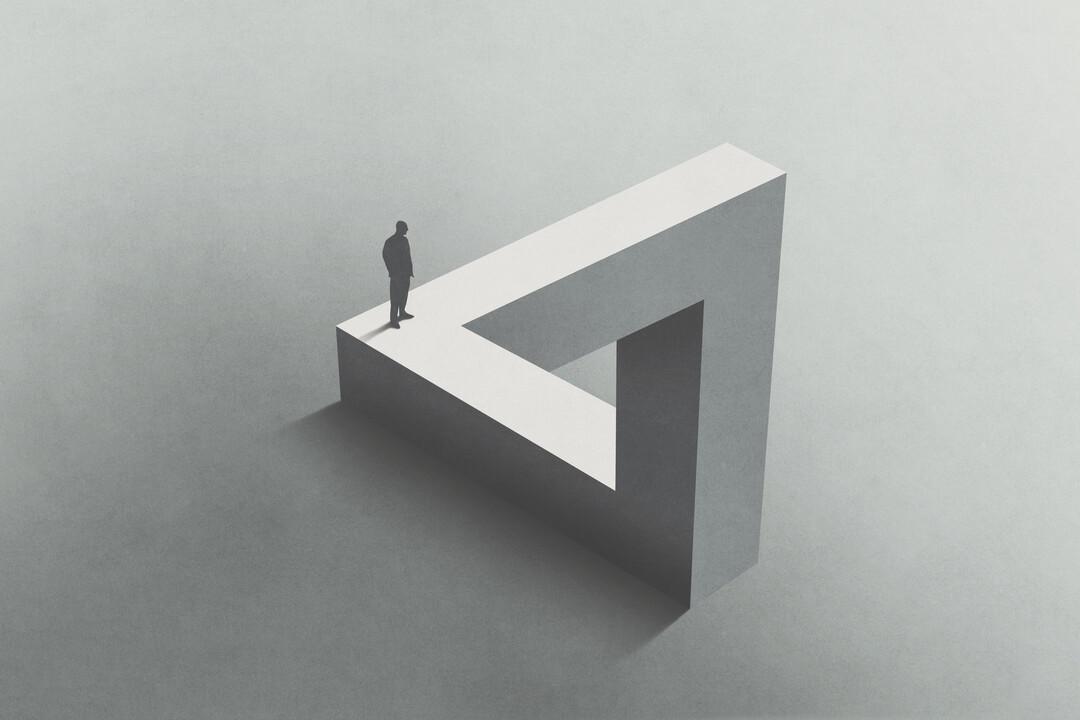

Imagine: Markets rarely move in material ways based on what has happened. They are moved by the future, what is to come, not what has been. But because tomorrow often looks quite like today, and today looks rather like yesterday, most people expect a long string of days that look more or less the same. A state of perpetual stability. It also so happens that betting on stability allows traders to earn positive carry or sell volatility, which are really the same things. This sort of trading is the easiest way to make money most of the time. Until something really changes.

Imagine II: Sometimes real change happens very quickly. Russia’s invasion of Ukraine happened fast. 9-11 changed the world in a day. But really big changes usually unfold over many months, quarters, years, decades. And the future is not preordained. Sometimes change yields to periods of mean reversion. Other times change is reflexive and accelerates nonlinearly to wild extremes, only to reverse dramatically. But in any case, anticipating future change requires one to imagine a tomorrow that looks different from today. Doing this well is very hard.

Imagine III: Imagination is the most powerful force in the universe. Our greatest achievements have manifested it. And because markets typically live in the future, they are priced to reflect what we imagine that forward state to be. The greatest booms and busts have been built upon imagined futures that failed to fully materialize. So, it is important to understand at any given time what the market’s collective imagination sees unfolding. And then consider a range of alternative imagined states of the world and look for signs we are shifting from one to another.

Imagine IV: The market imagined for decades that this was China’s century. More recently, investors have begun to imagine a China profoundly crippled by Xi and his hard turn toward authoritarianism. It has become increasingly easy to see such a future. With sentiment so deeply depressed, it is worth trying to imagine what a period of mean reversion might look like, even if it is just produces a tradeable rally. Afterall, China has never been anything other than a trade. It is not a long-term investment. Pick a Chinese stock index and look at it over 30yrs. You’ll see.

Imagine V: For a few years, the market imagined a US recession that never materialized. The preconditions for this ongoing economic expansion and the breathtakingly large deficits we now run are so unique that investors generally failed to imagine today’s reality. And now, visions for the future seem to be a soft landing, a no landing. Not long ago the market imagined six rate cuts this year. Now it imagines one or two. Should we imagine what the world might look like with a return to aggressive rate hikes? Or should we consider a world of deep financial repression?

Imagine VI: Pre-covid economists imagined the US would suffer from secular stagnation for decades. The Japanification of America. Now investors imagine a Japan that looks like America with its shareholder activism. And we see investors wonder whether the US might look like it did in the inflationary 1970s. Some investors imagine a bright future fueled by AI and a productivity explosion. Still others see WWIII over the horizon. So many possible futures. As investors we must consider each, imagine our own too, and bet on which idea catches fire. Even if just for a time.

Anecdote: “Lights go on and the rats still scatter,” grunted Bulldog, one of the great trading talents. “That tells you bulls remain too scared. Bad news hits the tape, they scramble for safety, puking longs, buying puts,” he growled. “That’s not how markets make a top. Major highs happen after everyone’s turned into an idiot, leveraged limit long into some kind of Madoff ponzi investment thesis that can’t go wrong, bragging about being geniuses. This time it’s probably AI.” I hadn’t checked in with Bulldog for a while; a never-wake-a-sleeping-dog kind of thing. But it felt time. “This market is going to suck in all these goddamn Baby Boomers sitting safely in money market funds. When the S&P is up 30%, they’ll pile into stocks. That’s why I’m nosebleed long, literally not a dollar of cash. Been buying gold and silver coins by the crate for five years too,” barked Dawg, a broken ear, torn in some ancient market brawl. “When the VIX gets down to 10, it’s over, it’s the signal they’re all sucked in. Then markets remind us how vicious they are. They’re rabid animals, ferocious, merciless.” 2020. 2008. 2000. 1997-98. 1992. 1987. 1974. 1970. 1929. “You think the government could pump this much borrowed money into the economy, lift home prices like they are, crank the debt to $34trln, a new $1trln every hundred days, then jack overnight rates to 5.5%, triple mortgage rates, gas prices, food prices, and have it all work out? Total insanity.” And Dawg laid down with a thud, gnawed his forepaw, aggravated, aggressive, some little parasite. “The S&P will be down 70-80% at the lows, we’ll get 3 months of deflation. 10yrs get back down near 0%. Then the Fed balance sheet that was $870bln pre-GFC and is $7.4trln now, will explode to $25trln. We then get the big inflation; you’ll need to flip all your positions.” I made a mental note to buy Dawg a studded Bitcoin collar for Christmas. “The Boomers will get destroyed; they deserve it, they screwed their kids. Then they’ll pile into 2yr notes at 50bps with whatever they have left after puking their stocks, terrified,” growled Bulldog, drooling horribly, unapologetically. “And by 2030 I’ll be buying T-bills at 20%.”

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.