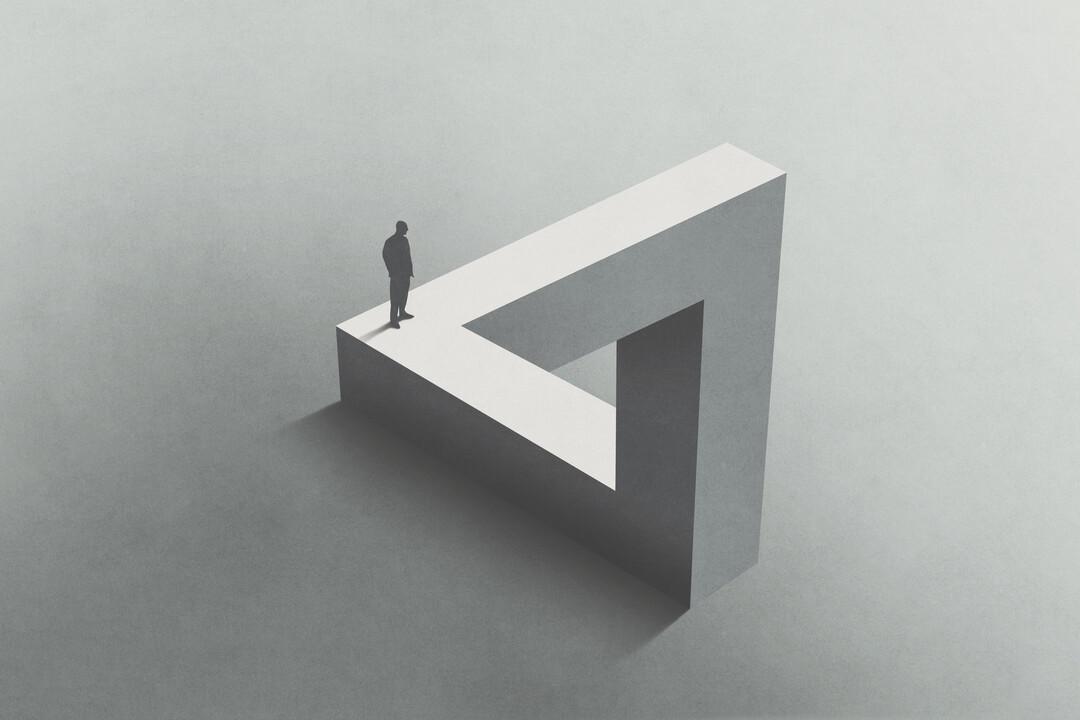

“When Heaven is about to confer a great office on a man, it first exercises his mind with suffering, and his sinews and bones with toil,” whispered Xi to himself, contemplating the ancient wisdom of Mencius, born 100yrs after Confucius and considered Confucianism’s 2nd sage. “It exposes his body to hunger, and subjects him to extreme poverty; it confounds his undertakings,” continued Xi, alone on a long walk. “By all these methods it stimulates his mind, hardens his nature, and supplies his incompetencies.” Xi’s intelligence services had sent him TikTok videos of Jensen Huang, the founder/CEO of Nvidia, who spoke this week at Stanford University, in the heart of Silicon Valley. Jensen was born in Taiwan in 1963, his ancestors having escaped from the Communists all those years ago. His family made their way to Kentucky, where Jensen was mercilessly bullied by racists and worked at Denny’s where he washed dishes and cleaned toilets as he made his way through school. And now this remarkable man who in a parallel universe would have grown up as a Chinese national, is worth $80bln and built the firm which is leading the West into an unknowable future of artificial intelligence. “Greatness comes from character and character isn’t formed out of smart people – it’s formed out of people who suffered,” said Jensen Huang to the captivated Stanford students. “I was fortunate that I grew up with my parents providing a condition for us to be successful on the one hand, but there were plenty of opportunities for setbacks and suffering,” continued Huang, his wisdom racing across social media. Xi sighed, increasingly confused, marveling at Jensen’s wildly popular reception, while his directive to Chinese youth to “eat bitterness” had left them lying flat. “I don’t know how to do it for all of you Stanford students, but I wish upon you ample doses of pain and suffering,” said Huang, as Xi felt a growing sickness rise from within.

Week-in-Review: Mon: Biden releases $7.3t 2025 budget proposal focused on delivering more middle-class tax breaks and price controls funded through higher taxes on the wealthy, local news reports suggest BOJ preparing to abandon 10y YCC target at March meeting, ECB’s Kazimir reiterates data dependence / suggests cuts won’t come before June, Lula works to ease fears related to the Petrobas canceled dividend payment, Biden says Israel invasion of Rafah would cross a redline, NY Fed CPI expectations survey show a rise for 3y & 5y points, Japan 4Q GDP 0.4% (1.1%e) / GDP Deflator YoY 3.9% (3.8%e), S&P -0.1%; Tue: CPI 3.2% (3.1%e) / Core 3.8% (3.7%e), NVDA rally carries market despite higher yields following strong infl report, BOJ’s Ueda says consumption remains weak, Hezbollah launches largest attack on Israel since the 10/7 massacre, EU parliament calls for the suspension of funds to Hungary / gov’t reviewing a bill to enable potentially damage CB independence, Japan PPI 0.6% (0.5%e), Turkey IP 1.1% (1.5%e), UK Unemp rate 3.9% (3.8%e), India IP 3.8% (4.1%e) / CPI 5.09% (5.04%e), Brazil IPCA 4.50% (4.45%e), Mexico IP 2.9% (2.2%e), US NFIB 89.4 (90.5e), S&P +1.1%; Wed: House passes Tik-Tok “divest or ban” bill, ECB’s Villeroy said more likely to start cutting in June, Toyota and other large employers agree to wage hike requests from unions, BOJ reportedly considering ending ETF purchases but continuing with JGBs, Chinese copper smelters considering cutting production, Trump and Biden secure enough delegates to be their respective party nominees, US 30y auction = strong, Netanyahu says entering Rafah key to success, S. Korea Unemp 2.6% (3.0%e), UK IP 0.5% (0.8%e), EU IP -6.7% (-3%e), Russia CPI 7.69% (7.61%e), S&P -0.2%; Thu: US PPI (1.6% vs 1.2%e / Core 2% vs 1.9%e) - strong but PCE-related components less worrying, Japanese news agency Jiji reports that BOJ has made plans to exit NIRP at next week’s meeting / former BOJ member Hayakawa suggest BOJ will wait until April, IEA report indicates oil mkts could face supply deficit this year, ECB’s Stournaras suggests need to cut 4x this year / doesn’t need to wait for Fed, Hungary delays CB bill, Mnuchin reportedly putting group together to purchase TikTok, S. Africa Mfg prod 2.6% (0.9%e), Brazil ret sales 4.1% (0.8%e), US Initial claim 209k (218k e), US ret sales control group 0% MoM (0.4%e), S&P -0.3%; Fri: Japan’s first round Shunto results show 5.28% wage hikes – much higher than 3.8% last year and the ‘high 4%’ expectations of last week, China holds 1y MLF rate / slightly reduces liquidity via the medium term lending facility (first time since Nov 22), N. Zealand FinMin Willis says growth projections are gloomy, Senator Schumer calls for Netanyahu to step down, Hamas proposed what it calls a comprehensive ceasefire plan – Israel is suspect, Russian presidential ‘election’ begins, China M2 8.7% (8.8%e) / agg financing 8.06t (6.501t prev), Poland CPI 2.8% (3.2%e), US emp mfg -20.9 (-7e), US impt prices -0.8% as exp, US IP 0.1% MoM (0%e), US UofM sentiment 76.5 (77.1e) / 1y infl exp 3% (3.1%e) / 5-10y infl exp 2.9% as exp, S&P -0.7%; Sat: Navy men’s lacrosse beats #7 ranked John’s Hopkins 10-9 in overtime.

Weekly Close: S&P 500 -0.1% and VIX -0.33 at +14.41. Nikkei -2.5%, Shanghai +0.3%, Euro Stoxx +0.3%, Bovespa -0.3%, MSCI World -0.5%, and MSCI Emerging -0.2%. USD rose +6.9% vs Ethereum, +1.5% vs Sweden, +1.3% vs Yen, +1.3% vs Russia, +1.0% vs Australia, +1.0% vs Sterling, +0.6% vs Turkey, +0.5% vs Euro, +0.4% vs Canada, +0.4% vs Bitcoin, +0.3% vs Brazil, +0.2% vs South Africa, +0.1% vs China, +0.1% vs India, and flat vs Indonesia. USD fell -1.9% vs Chile, and -0.6% vs Mexico. Gold -1.1%, Silver +3.4%, Oil +3.9%, Copper +6.0%, Iron Ore -17.5%, Corn -0.7%. 10yr Inflation Breakevens (EU +7bps at 2.04%, US +3bps at 2.32%, JP +3bps at 1.23%, and UK +9bps at 3.61%). 2yr Notes +25bps at 4.73% and 10yr Notes +23bps at 4.31%.

2024 Year-to-Date Close: Denmark +16.2% priced in US dollars (+18.2% priced in krone), Ireland +10.4% priced in US dollars (+12.3% priced in euros), Italy +10% in dollars (+11.8% in euros), Japan +9.3% (+15.7%), Argentina +9.3% (+15%), Euro Stoxx 50 +8.5% (+10.3%), Turkey +8.5% (+18.2%), Greece +8.2% (+10%), S&P 500 +7.3% in dollars, Colombia +6.6% (+7.5%), Netherlands +6.5% (+8.3%), France +6.5% (+8.2%), NASDAQ +6.4% in dollars, Saudi Arabia +6.4% (+6.4%), Taiwan +6.1% (+9.8%), MSCI World +6.1% in dollars, Germany +5.3% (+7.1%), Philippines +5.3% (+5.8%), Malaysia +4.1% (+6.7%), Spain +3.2% (+4.9%), Russia +3% (+6.5%), Sweden +2.2% (+5.7%), Hungary +1.9% (+7.2%), India +1.8% (+1.3%), Canada +1.6% (+4.2%), Poland +1.6% (+2.2%), China +1.3% (+2.7%), Czech Republic +1.2% (+4.7%), Russell +0.6% in dollars, Israel +0.1% (+1.8%), UK -0.3% (-0.1%), Switzerland -0.5% (+4.8%), Mexico -0.8% (-2%), Indonesia -0.8% (+0.8%), HK -2.1% (-1.9%), Belgium -2.3% (-0.6%), Austria -2.3% (-0.7%), Chile -2.5% (+4.3%), Korea -2.9% (+0.4%), Australia -3% (+1%), Singapore -3.5% (-2.1%), UAE -3.7% (-3.7%), New Zealand -4.1% (0%), Norway -4.5% (+0.4%), Finland -4.9% (-3.4%), Thailand -6.8% (-2.1%), South Africa -7.9% (-5.3%), Brazil -8.2% (-5.5%), Venezuela -11% (-9.9%), Portugal -13.6% (-12.2%).

Thank God: “Value investors think China is cheap, at some point it’ll turn,” said the CIO, decades spent in HK, investing globally, Asia focused. “Perhaps they’re right,” he said, a light shrug. “But markets require capitalism, and capitalism requires rule of law.” China is one of the most important wildcards to track to understand the global economy, markets, geopolitics. “Confucius believed in rule by law, with the word of a wise, moral, ethical leader being law. Mencius (Confucianism’s 2nd sage) agreed about morals and ethics but argued for rule of law.”

Thank God II: “Xi Jinping believes in rule by law; what he says is law,” continued the CIO. “Now that Xi has shown his hand as he tightens his grip on the Party, economy, markets, what could he possibly say going forward that would entice any thinking person to take real risk?” he asked. “For the first time in my career, the Hong Kong tycoons have accepted that it’s over,” he said. “They feel the US has it in for them, and they see China as un-investable now,” he said. “Their grandparents fled the mainland in ’49 and taught them to never trust the Communists.

Thank God III: “The Party hired Xi in 2012 to clean up the mess of successive governments,” said the same CIO. “Rampant corruption of Party members, excessive dependency on property and fixed asset investment, environmental degradation, wealth inequality.” Existential threats to the Communist Party. “Xi looked at this rot and took it apart. It was his chance to introduce rule of law. Had he done so, he would have created a China that could have overtaken the US. But just like in 1949 he caused China’s talent to flee. We should thank God for the Communists.”

Thank God IV: “Xi saw the experiment with openness and wealth accumulation as dangerous to Party control,” he said. “He will subordinate everything to enhance state power in his quest to displace America as the world’s rule setter,” he said. “He’s telling you precisely what he’s going to do. Eat bitterness. And each day the surveillance state grows stronger.” AI will make it more so. “What we see as economic sickness, Xi sees a price worth paying, because at the other side of this challenge is China’s rightful place at the head of the table. That’s his objective.”

Thank God V: “Xi believes he can allocate capital to build China top down,” said the CIO. “He thinks he can create Nvidia by decree. But Jensen Huang’s grandparents fled China’s Communists in 1949. Jensen had a vision that accelerated compute would be the future. He suffered multiple failures, made numerous acquisitions over decades, took enormous risks.” 30yr overnight success. “TSMC likewise realized it needed to shrink the geometry to make it happen. ASML knew it needed to go beyond the current understanding of the physics of etching.”

Thank God VI: “TSMC’s gross cash flows that they can invest back in capital expenditure eclipses the entire market cap of China’s semiconductor industry,” he said. “Taiwan has an ecosystem with engineers and suppliers who have worked together and know how to talk to each other and make things happen.” No way China catches up. Nor does Intel. “And Sam Altman wants trillions to build data centers and buy chips. Google wants the same.” Microsoft too. “They’re signaling that this is where the future value lies.”

Thank God VII: “We’re entering a world where the value is in hard tech,” said the CIO. “Where doing important things are very difficult and capital intensive.” We have left a world of capital light opportunity - the software era is ending with the arrival of AI. “Google was built with $100mm and 1000 people. It’s the greatest business on earth,” he said. “Compare those two inputs to what Jensen had to build, it’s drastically different. And this will be more the norm for the people who build tremendous value. More dollars spent, more people, more risk, more time.”

Anecdote: “China’s inward turn will still allow for years of 2-4% growth,” said the CIO from HK. “Each year the Party will forecast better times ahead. They’ll say we’re weaning ourselves off bad habits.” Perpetual propaganda. “What’s interesting is that countries across Asia are now waking up to this problem and becoming more dynamic,” he said. “Having tried everything else for 35yrs of stagnation, Japan appears willing to try capitalism. It has countless tech companies with small global market share.” Consolidation will create real global competitors. “Tokyo realizes that if you want a defense industry you must pay for it. It’s expensive and requires hard tech.” The Europeans are realizing this too. “Seoul has too much dependence on China. And with Kim up north and US global engagement increasingly uncertain, they’re copying Japan and trying to increase corporate valuations.” Dynamic economies fund stronger militaries. “Indonesia has been a non-aligned country and now it wants to join the OECD,” he said. “China joined the WTO at the tail end of the Asian financial crisis,” he said. “Chinese people don’t need to be told how to make money, they sense profit, and go. The WTO was this gigantic green light to stopped cars at the red light. And they said this is it. If I want to make real money, I need to bet the farm. I’m going to build a big factory because now I can sell everything to everyone in America without a tariff.” Those who raced got rich. “In India, historically, entrepreneurs didn’t know what would happen when the government changed, so they built one small factory to ensure they didn’t have overcapacity,” he said. “India never scaled. But now you have a stable government with a consistent set of policies,” he said. “Ambani and Adani, they’re in a league all their own. But the next 50 people down the rankings have a chance and they’re going to go for it. These two guys can’t do everything. And the government needs aggressive risk takers to build the country. If you want to be Vanderbilt or Rockefeller this is your moment.”

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.