Dusted off an anecdote from 2018 (see below) about the changes happening in America and with Americans. Back then it became clear that a process of great significance was underway. It continued beneath the surface during the Biden years and has now manifested more clearly and forcefully than ever before.

Enjoy Presidents Day. Back next Sunday with full weekend notes. All the very best, E

Week-in-Review: Mon: Canada to reach out to US states with which it has significant trade relationships to persuade Trump to drop tariff plans. Musk-led consortium offers $100bn to take control of OpenAI. BoE’s Mann says ‘demand conditions’ in economy are ‘quite a bit weaker’. Romanian President Klaus Iohannis resigns ahead of election rerun. Goldman Sachs believes Trump’s immigration policy to shave 0.3-0.4 ppt off US economic growth. S&P +0.7. Tue: Trump imposes tariffs on aluminum and steel. US and Russia agree prisoner exchange. Fed’s Powell testifies before US Senate, says Fed is in ‘no rush’ to adjust rates, signals support for stablecoin regulation and reiterates that removing governors by the president is illegal. UK diverges from EU on response to US tariffs and artificial intelligence safety. World’s largest EV battery maker CATL files for Hong Kong listing. Jordan’s king meets Trump in push against Gaza takeover plan. Trump to halt enforcement of law banning bribery of foreign officials. NFIB small bus. optimism idx 102.8 (104.5e), Brazil inf 4.56% (4.58%e), S&P flat. Wed: House Republicans proposed cutting taxes by trillions of dollars and raising the deficit by $4.5 trillion over 10 years. Saudi Arabia launches ferocious state media attack on Netanyahu. NYSE to relocate 143-year-old Chicago stock exchange to Dallas, TX. Sudan agrees to deal for Russian naval base. South Africa vows to pursue Israel genocide case despite Trump pressure. US CPI 3.0% (2.9%e) / Core CPI 3.3% (3.1%), India CPI 4.31% (4.5%e), S&P -0.3%. Thur: Trump orders his trade advisers to come up with “reciprocal” tariffs on US trade partners. Trump suggests Russia should rejoin G7. India’s PM Modi visits White House and commits to take all undocumented Indians. India to increase military and energy purchases from US. Trump criticizes Canada over low defense spending. Trump to look at VAT in EU as a tariff. Germany CPI 2.3% as exp, UK GDP 1.4% (1.1%e), Brazil Ret sales 2.0% (3.1%e), US PPI 3.5% (3.3%e), US Jobless claims 213k (216k e) / Cont claims 1850k (1882k e), S&P +1%. Fri: JD Vance accused European leaders of undermining democratic values and played down the dangers of Russian election interference at the Munich Security Conference. Zelenskyy not to meet Putin until he has a ‘common plan’ with Trump. China says Europeans must have role in Ukraine talks and promises ‘resolute’ responses to US hostility. Saudi Arabia welcomes possibility of hosting Trump-Putin summit. European chiefs promise to speed up Ukraine’s accession to EU. China M2 7.0% (7.3%e), Eurozone GDP 0.9% as exp, Russia Key rate 21% as exp. / CPI 9.92% (9.90%e), S&P flat.

Weekly Close: S&P 500 +1.5% and VIX -1.77 at +14.77. Nikkei +0.9%, Shanghai +1.3%, Euro Stoxx +1.8%, Bovespa +2.9%, MSCI World +1.7%, and MSCI Emerging +1.5%. USD rose +1.9% vs Bitcoin, +1.1% vs Ethereum, +0.7% vs Turkey, and +0.6% vs Yen. USD fell -5.8% vs Russia, -2.3% vs Sweden, -2.3% vs Chile, -1.9% vs Brazil, -1.6% vs Euro, -1.5% vs Sterling, -1.2% vs Australia, -1.2% vs Mexico, -0.8% vs Canada, -0.7% vs India, -0.5% vs China, -0.1% vs Indonesia, and -0.1% vs South Africa. Gold +0.5%, Silver +1.3%, Oil -0.4%, Copper +1.7%, Iron Ore -0.9%, Corn +1.6%. 10yr Inflation Breakevens (EU -3bps at 1.82%, US +1bp at 2.44%, JP +3bps at 1.62%, and UK -3bps at 3.52%). 2yr Notes -3bps at 4.26% and 10yr Notes -2bps at 4.48%.

2025 Year-to-Date Equity Index Returns: Colombia +20.1% priced in US dollars (+12.5% priced in pesos), Poland +19.9% priced in US dollars (+15.3% priced in zloty), Chile +15.5% in dollars (+9.7% in pesos), Brazil +15.3% (+6.6%), Germany +14.3% (+13.1%), Hungary +14.2% (+10.4%), Czech Republic +14% (+12.1%), Euro Stoxx 50 +13.9% (+12.2%), Spain +13.4% (+11.7%), Sweden +12.9% (+9.4%), Austria +12.7% (+11.5%), HK +12.5% (+12.8%), France +12.5% (+10.8%), Italy +12.3% (+11.1%), Mexico +12.2% (+9.2%), Switzerland +11.6% (+10.7%), Greece +10.8% (+9.2%), South Africa +10.6% (+7.4%), Korea +10.4% (+8%), Finland +10% (+8.8%), Netherlands +9.4% (+7.7%), Norway +8.2% (+5.5%), Israel +8.2% (+6.1%), Australia +7.8% (+4.9%), UK +7.6% (+6.8%), Ireland +7.5% (+5.9%), MSCI World +5.2% in dollars, Canada +4.7% (+3.1%), Belgium +4.7% (+3.1%), Singapore +4.5% (+2.4%), S&P 500 +4%, NASDAQ +3.7%, Saudi Arabia +3.1% (+2.9%), Portugal +2.7% (+1.1%), Russell +2.2%, UAE +2.2% (+2.2%), New Zealand +1.6% (-0.9%), Japan +1.3% (-1.9%), Vietnam +1.1% (+0.7%), Taiwan +0.7% (+0.5%), China +0.5% (-0.2%), Turkey -1.9% (+0.5%), Malaysia -2.2% (-3.1%), India -4.2% (-3%), Denmark -4.4% (-5.5%), Indonesia -6.2% (-6.2%), Philippines -6.9% (-7.2%), Thailand -7.9% (-9.1%), Argentina -8.1% (-5.8%).

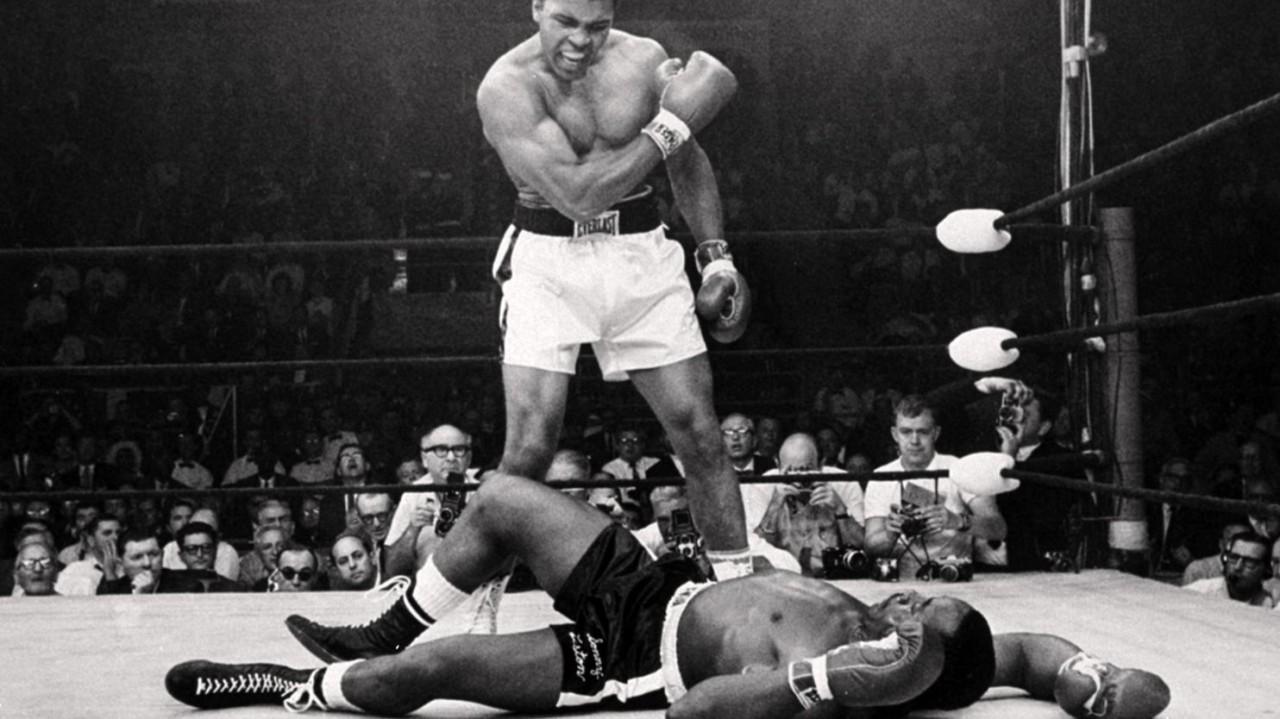

Anecdote (Dec 2018): “We are trying to understand America, Americans,” said the soft-spoken Scandinavians, financial market pillagers. “America has been the world’s moral authority. And okay, so perhaps you have not always lived up to that. But you have tried. And it has been this way for our whole lives.” I nodded. “You have stood as the protector of global trade. Free trade. Democracy. And what is right versus wrong. America has defended the weak.” One of the many wonderful rewards of travel is to see yourself reflected in foreign eyes. Throughout today’s Scandinavia, America’s reflection looks the same. “It has been this way for many, many of your Presidents. And now it seems that this has all changed.” Scandinavians are trying to make sense of the changes happening in America. They’re not alone. Americans are trying too. I explained that we had reached a tipping point, driven by income and wealth inequality, amplified by income insecurity, in a technologically disrupted world transforming faster than at any time in human history. And instead of voting for more of the same, we voted for change. Real change. A redistribution of economic spoils between capital and labor. A redefinition of our relationship with foreigners; neighbors, friends, enemies. And in the pursuit of these things, we’re attacking orthodox thinking on every front. NATO, trade, immigration, climate change, free speech, economic stimulus, deficit spending, central bank independence. We have also decided to slow China’s ascent. And while no one knows where this will lead, surely it will change the trajectory of the trends that dominated recent decades. “Well, we see that America has now begun to use its economic and military might to take what it wants. And this returns the world to something we have not seen for a very, very long time – where might makes right. To the law of the jungle.”

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.