“The plebes on my team asked for advice on defending against jabs,” said Liv, her freshmen nervous about combatives training, a mandatory hand-to-hand combat program at West Point. “So, I told them what my teacher taught me.” Her senior year in high school, Liv marched her 5 feet 4 inches to a gritty MMA gym in Stamford and took to it. “He had me stand still and let each guy in the gym hit me with a jab to the face. Then he said, good, now you know you can take a hit like that,” said Liv, discovering wisdom resides in unexpected places. “So, I told my plebes, stay focused, take the jabs, they’re an annoyance, they’re intended to distract you from the real danger, punches.”

Overall: “I would like to die on Mars,” said Elon, seated on camera next to Trump, promoting the president’s sweeping agenda. “But not on impact.” It’s the kind of joke you’d expect from the person who coined the term Rapid Unscheduled Disassembly to describe his countless rocket malfunctions. They’re spectacular of course. Spectacles. Metaphors. In the right hands, each failure contains within it the seeds of success. In 2024, SpaceX conducted 134 orbital launches, 51% of the global total. Its rockets dwarf competitors, so it accounted for 85% of the global payload mass. And now the world’s most powerful nation with its largest economy is embarking on an experiment to see if it can operate more like SpaceX than Boeing, more like Nvidia than Intel. Every American would like that very much. But greatness is easy to love. The journey there is another matter, the uncertainty, the fear that after decades of struggle and sacrifice you may be rewarded with humiliation, defeat in the ring. Few have that stamina, that maniacal drive, and instead opt for the comfort of stasis. “We need to have discussions with both the British and the French - the two European nuclear powers - about whether nuclear sharing, or at least nuclear security from the UK and France, could also apply to us,” said Friedrich Merz, Germany’s CDU leader and favorite to be its next Chancellor in today’s elections. “We must prepare for the possibility that Donald Trump will no longer uphold NATO’s mutual defense commitment unconditionally,” continued Merz, the 3rd anniversary of Russia’s invasion approaching, Germany’s economy contracting for two successive years, its deindustrialization manifest, its defense spending inexplicably still just 2% of GDP. “That is why, in my view, it is crucial that Europeans make the greatest possible efforts to ensure that we are at least capable of defending the European continent on our own.”

Week-in-Review: Mon: Xi meets China’s business titans including Alibaba’s Jack Ma. European countries clash over sending troops to Ukraine. Fed’s Waller says recent economic data support keeping rates on hold and tariffs would only cause temporary increase in prices. Zelenskyy ‘will not recognize’ US-Russia talks that exclude Ukraine. Israeli troops to keep control of 5 ‘strategic’ locations inside Lebanon. Japan Q4 GDP +0.7% (0.2%e), S&P 500 closed. Tue: US-Russia talks in Riyadh spark European fears of Ukraine settlement on Putin’s terms. France’s Macron spoke separately with Trump and Zelensky on aligning with the US on peace talks. Four of the EU’s top central bankers urge the bloc’s regulatory arm to simplify regulation on commercial lenders. Germany’s Chancellor Scholz and electoral frontrunner Merz rule out serving in a cabinet together whatever the outcome of Sunday’s election. China’s state weather agency is considering using Deep Seek to power its forecasts. OpenAI to fend off hostile takeover from Musk by allowing its non-profit board to maintain control after conversion to a for-profit business. RBA cuts 0.25% to 4.1% as exp, RBNZ cuts 0.5% to 3.75% as exp, France CPI 1.7% (1.4%e), Canada CPI 1.9% as exp, Empire State Manuf. Index 5.7 (-1e), ZEW survey current conditions -88.5 (-89.2e), S&P +0.2%. Wed: Trump calls Zelensky ‘a dictator’ after Ukraine’s leader accuses him of living in ‘disinformation space’. Trump plans to impose tariffs on cars, chips and drug imports of around 25% with an announcement as early as April 2. The Fed’s January minutes show the FOMC discussed the concerns created by Trump’s proposed policy changes, with a bias toward upside inflation risks. China’s decline in new-home prices eases for a fifth month in January. UK CPI 3.0% (2.8%e) / Core 3.7% as exp / RPI 3.6% (3.7%e), US Housing starts 1366k (1390k e), S&P +0.3%. Thur: Trump says a fresh trade deal with China is possible without providing further details. Trump said he’s mulling tariffs of 25% on lumber, adding that they could come into effect around April 2. Trump accuses Ukraine of breaking a deal with the US on critical minerals. Bessent says US is ‘a long way off’ from extending maturity of bond issuance. A record 60+% of Japanese companies plan to raise workers’ wages next year as due to tight labor market. Three Chinese warships were spotted in international waters off the coast of Sydney. Trump floats the possibility of giving 20% of DOGE savings to Americans. US Jobless claims 219k (215k e) / Cont. claims 1869k (1868k e), Eurozone Cons conf -13.6 (-14.0e), S&P -0.4%. Fri: Bessent talks about rebalancing China’s economy with his counterpart. US Treasury signals sanctions relief for Russia are on the table in peace talks. The US gave Ukraine an ‘improved’ minerals deal. NEC director Hasset says US revenue from the 10% levies on China may be between $500bln and $1trln over the next 10yrs. Fed’s Mussallem sees increased risk that inflation may stall above 2% and policy should remain ‘modestly restrictive’. Fed’s Bostic still expects two rate cuts this year despite the ‘greater uncertainty’. JPMorgan reclassified Qatar and Kuwait as developed markets and will remove them from its emerging-markets bond index. China vows further support to boost tech consumption, including AI products. The PBOC pledges to innovate macroprudential tools to promote economic recovery. US PMI Mfg. 51.6 (51.5e) / Serv. 49.7 (52.8e), Mich sent idx 64.7 (67.8e), Japan Core CPI 3.2% (3.1%e), UK Cons. Conf -13.6 (-13.9e) / Ret. Sales 1% (0.8%e), EZ Comp. PMI 50.2 (50.5e) / Mfg 47.3 (47e), S&P -1.7%.

Weekly Close: S&P 500 -1.7% and VIX +3.44 at +18.21. Nikkei -1.0%, Shanghai +1.0%, Euro Stoxx +0.3%, Bovespa -0.9%, MSCI World -1.4%, and MSCI Emerging +2.0%. USD rose +0.6% vs Chile, +0.6% vs Brazil, +0.5% vs Mexico, +0.5% vs Turkey, +0.3% vs Euro, +0.3% vs Canada, and +0.3% vs Indonesia. USD fell -3.1% vs Russia, -2.1% vs Ethereum, -2.0% vs Yen, -1.6% vs Bitcoin, -0.4% vs Sweden, -0.4% vs Sterling, -0.1% vs India, -0.1% vs Australia, -0.1% vs China, and flat vs South Africa. Gold +1.8%, Silver +0.5%, Oil -0.4%, Copper -2.1%, Iron Ore +2.9%, Corn -0.7%. 10yr Inflation Breakevens (EU -1bp at 1.81%, US -2bps at 2.42%, JP +3bps at 1.65%, and UK -1bp at 3.51%). 2yr Notes -6bps at 4.20% and 10yr Notes -4bps at 4.43%.

2025 Year-to-Date Equity Index Returns: Colombia +27.5% priced in US dollars (+18.2% priced in pesos), Poland +21.1% priced in US dollars (+17% priced in zloty), HK +17% in US dollars (+17% in HK dollars), Chile +14.8% in dollars (+9% in pesos), Brazil +14.5% (+5.7%), Czech Republic +14% (+12.9%), Hungary +13.9% (+11%), Sweden +13.7% (+9.7%), Korea +13.5% (+10.6%), Italy +13.1% (+12.4%), Euro Stoxx 50 +13.1% (+11.8%), Spain +12.9% (+11.7%), Germany +12.7% (+11.9%), Switzerland +12.5% (+11.6%), France +11.7% (+10.5%), South Africa +11.4% (+8%), Greece +11.3% (+10.1%), Austria +11.3% (+10.5%), Mexico +11.3% (+8.5%), Finland +10.7% (+10%), Ireland +10% (+8.8%), Israel +9.5% (+6.7%), Norway +9.4% (+6.8%), Netherlands +7.9% (+6.7%), UK +7% (+6%), Singapore +6.2% (+3.8%), Australia +4.8% (+1.7%), Belgium +4.4% (+3.3%), MSCI World +3.6% in dollars, Taiwan +3.1% (+3%), Saudi Arabia +3.1% (+2.9%), Canada +2.9% (+1.7%), Portugal +2.9% (+1.8%), Japan +2.4% (-2.8%), Denmark +2.4% (+1.7%), S&P 500 +2.2%, Vietnam +2.2% (+2.4%), UAE +2.1% (+2.1%), China +1.5% (+0.8%), NASDAQ +1.1%, New Zealand 0% (-2.7%), Russell -1.6%, Malaysia -1.9% (-3.1%), Indonesia -4.5% (-3.9%), India -4.8% (-3.6%), Turkey -5.3% (-2.3%), Philippines -6.6% (-6.6%), Argentina -9.1% (-6.7%), and Thailand -9.2% (-11%).

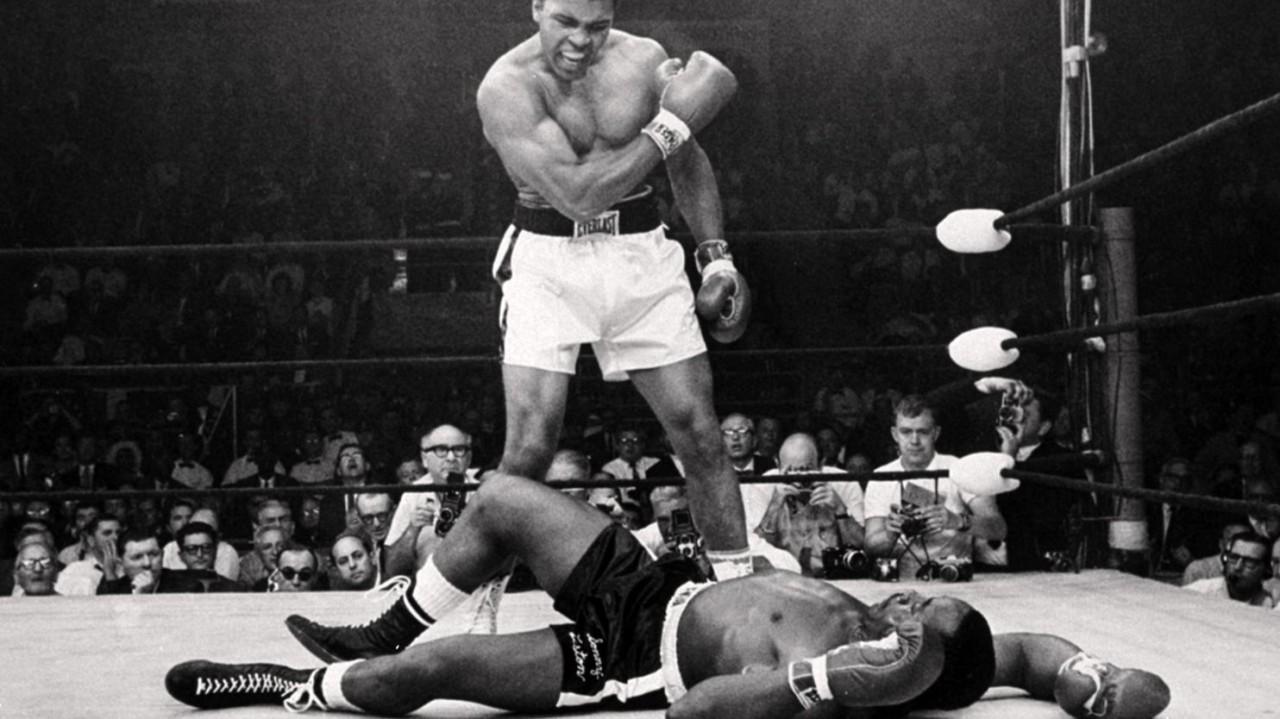

Muhammad: “Float like a butterfly, sting like a bee. The hands can’t hit what the eyes can’t see,” said Muhammed Ali, the greatest boxer to ever live. He used his jab unconventionally, as a tool of deception, setting up for powerful punches. “A man who has no imagination has no wings.” He flicked the jab rather than planting his feet for a stiff, powerful one, allowing him to stay light on his feet and move fluidly. “The fight is won or lost far away from witnesses - behind the lines, in the gym, and out there on the road, long before I dance under those lights.”

Muhammad II: “Champions aren’t made in gyms. Champions are made from something they have deep inside them - a desire, a dream, a vision,” said Ali. Many boxers use a single jab to set up a combination, but Ali often threw two or three in rapid succession. His jab was as much about mental dominance as it was about physical impact. We see the same psychological games being played in today’s Great Power fight for geopolitical dominance. “I hated every minute of training, but I said, ‘Don’t quit. Suffer now and live the rest of your life as a champion.’”

Rope a Dope: “Europe is facing a world undergoing dramatic change,” said Mario Draghi last September, addressing the European Parliament, presenting his report on European Competitiveness. “World trade is slowing, geopolitics is fracturing, and technological change is accelerating. It is a world where long-established business models are being challenged and where some key economic dependencies are suddenly turning into geopolitical vulnerabilities. Of all the major economies, Europe is the most exposed to these shifts.”

Rope a Dope II: “We are the most open: our trade-to-GDP ratio exceeds 50%, compared with 37% in China and 27% in the United States,” said Draghi. “We are the most dependent: we rely on a handful of suppliers for critical raw materials and import over 80% of our digital technology. We have the highest energy prices: EU companies face electricity prices that are 2-3 times higher than those in the United States and in China. We are severely lagging behind in new technologies: only four of the world’s top 50 tech companies are European.”

Rope a Dope III: “We are the least ready to defend ourselves: only ten Member States spend more than or equal to 2% of GDP on defense, in line with NATO commitments,” said Draghi, the war with Russia then over 2.5yrs running. “In this setting, we are all anxious about the future of Europe. My concern is not that we will suddenly find ourselves poor and subservient to others. We still have many strengths in Europe. It is that, over time, we will inexorably become less prosperous, less equal, less secure and, as a result, less free to choose our destiny.”

Rope a Dope IV: “The European Union exists to ensure that Europe’s fundamental values are always upheld: democracy, freedom, peace, equity and prosperity in a sustainable environment. If Europe cannot any longer deliver these values for its people, it will have lost its reason for being,” warned Draghi. He then proposed a dramatic 5% of GDP increase in investment spending to: (1) Close the innovation gap with the US and China, (2) Decarbonize, lower energy prices and boost competitiveness, and (3) Increase security and reduce dependencies.

Anecdote: The breadth and depth of distractions are extraordinary these days. Skinning up the mountain, the air thin, cold, a bitter gust. People appear to be losing their minds, frightened of anything, everything, like in the depths of a major crisis, and even so, markets remain rather firm, placid. International equities are outpacing the US so far this year. And Germany’s Dax index is 16.4% higher than the day before Trump was elected, while the S&P 500 has gained just 5.3%, and the Russell 2000 as a benchmark for America’s domestic economy is only +1.1%. All movement in nature holds meaning, signs, signals. Far across the valley lay the Tetons, concealed, enveloped. At their feet the Snake River, its dark narrow line defiant, refusing to freeze. Will the unfolding change in America’s relationship with the world bring about more or less global growth? That’s the most important question for now. Japan’s Nikkei 225 is 5.4% higher since November 4th. And China’s CSI 300 index has gained 2.2%. In a more dangerous and uncertain world, will rising existential risks to nations be the catalyst that unlocks greater deficit spending to boost defense and spur economic growth, investment, independence, dynamism? Ukraine’s invasion by Europe’s most fearsome mortal enemy failed to snap Brussels from its trance. It appears that only Europe’s staunchest ally holds the power to break this spell. And with America’s retreat from unconditional support, Europe will now rearm in earnest. Will it also use this crisis to consolidate? That is not today’s trade, but one on the horizon. From the summit, the elk are dark dots along the valley floor, at their herd’s edge the coyotes, light-footed, menacing, patient. An eternal dance, brutal, beautiful. Beijing’s patience with China’s painful deleveraging and corresponding economic weakness appears to be running thin in this more dangerous world. If both China and Europe shift to a pro-growth policy, lest they be left behind, staggering in the cold, where will that leave the US and its exceptionalism?

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.