“Hardest thing I’ve ever done,” said Teddy, recovering from the Norwegian Ruck March. The tradition started within Norway’s military in 1915. Cadets march/run an 18.6-mile course with 1,400 feet of elevation, carrying a 25lb pack, body armor, water. Timed. All for bragging rights and a little pin. They did it late Friday night in the rain. “Wouldn’t be able to graduate without doing this, can’t be a wus.” The great thing about hard things is that they reset the limits of what we know we can do. “I was so spent, and the last few miles I kept telling myself, I’m going to make it one more lamplight, one more lamplight, just one more lamplight.”

Overall: “DeepSeek-R1 is AI’s Sputnik moment,” posted Marc Andreesen on X, talking his book as all great investors do. Nothing could be better for the venture tech business than an existential race for AI supremacy. But given the whole world’s fascination with AI, will DeepSeek represent a broader Sputnik moment for America? It’s important of course, because competition lifts us all. The higher the stakes, the more determined and creative our efforts. Profits tend to compound alongside our advances, and so it is that the S&P 500 index which launched in 1957, months before the Soviet Union hurled Sputnik into orbit, has rallied 91,411% (including dividends) through 2024 (that’s a +10.6% average annual return, +6.7% real). But such financial returns pale in comparison to our engineering accomplishments. Since Sputnik ignited the American drive to dominate all rivals, our scientists have invented supercomputers that are 100 trillion times faster than the 1957 state of the art IBM 704. Back then, Khruschev wanted to import American technology and equipment, but the US restricted such transfers. Soviet exports to the US in 1957 were $16.8mm/yr, imports were $4.5mm. That’s what that Cold War looked like. What might today’s eventually look like? The Australian Strategic Policy Institute published a 2024 paper covering 64 critical technologies across sectors, including defense, space, energy, artificial intelligence, robotics, cyber computing, biotechnology, advanced materials, and quantum technologies. From 2003 to 2007, the US led the world in 60 out of 64 critical technologies. However, from 2019 to 2023, China leads in 57 out of 64 technologies, while the US now leads in only 7. China’s most recent gains have occurred in quantum sensors, high-performance computing, gravitational sensors, and advanced semiconductor chip making. The US now has a truly formidable competitor. It should be a terrifying prospect for lazy Americans. And a wakeup call for all exceptionalists. The most exciting and high-stakes race in all human history is now well underway. And the question of our day, is will Americans again rise to the moment?

Week-in-Review: Mon: Chinese DeepSeek unveils AI large language and reasoning models, on par with industry leading Open AI models. “AI trade” and energy names suffer as DeepSeek’s models are said to use fewer advanced chips and are more energy efficient. US Treasury’s Bessent pushes gradual 2.5% universal US tariffs plan. Trump rescinds tariffs on Colombian goods after reaching a deal on the return of deported migrants. UK to give businesses greater access to pension scheme surpluses in bid to boost investment. China investigates domestic generic drugs over safety concerns. Israel started allowing Palestinians to return to northern Gaza. The White House earlier said Israel and Lebanon extended their truce until Feb 18. China PMI Mfg 49.1 (50.2e), German Ifo bus. sent. Idx 85.1 (84.7e), US New home sales 698k (675k e), S&P -1.5%. Tue: US civil servants asked to return to the office 5 days a week or accept redundancy package. Canada says China, India and Russia have interfered in recent elections. UK PM Starmer will demand UK ministers prove economic impact of policies before approval. Trump pressures Egypt and Jordan to accept Gaza “clean out” plan. Israeli military to hold on to Syrian territory indefinitely. Trump pushes India to buy more US weapons in trade rebalancing. Serbia’s prime minister resigns after weeks of mass protests. US Durable goods orders -2.2% (0.6%e), US cons. Conf. 104.1 (105.7e), S&P +0.9. Wed: Powell says Fed does “not need to be in a hurry” to adjust policy stance even if fed funds rate “meaningfully above neutral rate”. BoC cuts rate for 6 consecutive meeting; says “long-lasting and broad-based” tariff war would hurt Canadian economy. Trump criticizes Fed for failing to control inflation. Trump says US will send some illegal immigrants to Guantánamo. Data provider Vandatrack says retail investors poured record $900m into Nvidia shares in last 2 trading days. Syria asks Russia for reparations as Kremlin delegation arrives to Damas. Czech central bank head wants to buy billions of euros in bitcoin. SoftBank in talks to invest up to $25bn in OpenAI. US FOMC keeps rates at 4.25%-4.5% as exp, Switzerland Policy Rate 2.25% as exp, Canada Rate Decision 3% as exp, Eurozone M3 3.5% (3.9%e), Mexico Unemp rate 2.43% (2.54%e), S&P -0.5%. Thur: ECB warns of ‘headwinds’ to Eurozone economy as it cuts rates. Trump says he might exclude oil from tariffs on Canada and Mexico. China builds huge wartime military command center in Beijing. South Africa warns Rwanda of “declaration of war” after assault in DRC. Norway’s government collapses over EU energy dispute. Meta’s Zuckerberg pledges to spend “hundreds of billions” in AI. Hamas frees 3 Israelis and 5 Thais in largest hostage release. Gold hits all-time high. US GDP ann QoQ 2.3% (2.6%e), Eurozone Deposit facility rate 2.75% as exp / refinancing rate 2.9% as exp / lending facility 3.15% as exp, US Jobless claims 207k (225k e) / cont claims 1858k (1902k e), France GDP 0.7% (0.8%e), Eurozone GDP 0.9% (1.0%e), Eurozone Unemp rate 6.3% as exp, S&P +0.5%. Fri: US says it will push ahead with tariffs against Canada, Mexico and China. Canada’s Freeland vows to put retaliatory tariffs on Teslas, wine and liquor produced in the US. German parliament rejects opposition leader Merz’s migration bill backed by far-right party AfD. Trump envoy to meet Venezuelan leader Maduro on migrant deal. Nvidia CEO Huang meets Trump at White House. Gold hits other all-time high. US PCE 2.6% as exp / Core PCE 2.8%e as exp, US consumer spending 0.7% (0.6%e), UK house price idx YoY 4.1% (4.3%e), France CPI 1.4% (1.5%e), Germany unemp rate 6.2% as exp. S&P -0.5%.

Weekly Close: S&P 500 -1.0% and VIX +1.58 at +16.43. Nikkei -0.9%, Shanghai -0.1%, Euro Stoxx +1.8%, Bovespa +3.0%, MSCI World -0.5%, and MSCI Emerging +0.3%. USD rose +2.0% vs Mexico, +1.6% vs Sweden, +1.5% vs Australia, +1.5% vs South Africa, +1.4% vs Canada, +1.3% vs Euro, +0.9% vs Russia, +0.8% vs Indonesia, +0.7% vs Sterling, +0.5% vs Bitcoin, +0.5% vs India, +0.2% vs Turkey, flat vs China, and flat vs Ethereum. USD fell -1.2% vs Brazil, -0.5% vs Yen, and -0.2% vs Chile. Gold +1.0%, Silver +3.5%, Oil -2.9%, Copper -1.0%, Iron Ore +1.1%, Corn -0.9%. 10yr Inflation Breakevens (EU -4bps at 1.89%, US +1bp at 2.43%, JP -3bps at 1.57%, and UK flat at 3.60%). 2yr Notes -7bps at 4.20% and 10yr Notes -8bps at 4.54%.

2025 Year-to-Date Equity Index Returns (Dec 31-Jan 31): Colombia +15.4% priced in US dollars (+10.3% priced in pesos), Poland +11.7% priced in US dollars (+9.8% priced in zloty), Brazil +11% in dollars (+4.9% in reais), Germany +9.4% (+9.2%), Hungary +9.1% (+7.8%), Euro Stoxx 50 +8.7% (+8%), Chile +8.6% (+7.3%), Norway +8.5% (+7.4%), France +8.5% (+7.7%), Switzerland +8.2% (+8.6%), Sweden +7.5% (+7.5%), Spain +7.4% (+6.7%), Italy +7% (+6.7%), Korea +6.5% (+4.9%), Czech Republic +6.5% (+6.3%), Finland +6.3% (+6%), Greece +6.1% (+5.4%), Australia +5.8% (+4.6%), Austria +5.8% (+5.5%), Netherlands +5.6% (+4.9%), UK +5.6% (+6.1%), Ireland +5.3% (+4.6%), Mexico +5.2% (+3.4%), Israel +4.9% (+3%), South Africa +4.8% (+3.2%), MSCI World +3.5% in dollars, Saudi Arabia +3.3% (+3.1%), Canada +3.2% (+3.3%), Singapore +2.8% (+1.8%), S&P 500 +2.7%, Russell +2.6%, Taiwan +2.2% (+2.1%), Belgium +2.1% (+1.4%), UAE +1.8% (+1.8%), NASDAQ +1.6%, Vietnam +1.4% (-0.1%), Portugal +1.2% (+0.5%), Japan +0.7% (-0.8%), New Zealand +0.6% (-0.9%), HK +0.6% (+0.8%), Turkey +0.4% (+1.8%), Indonesia -0.2% (+0.4%), Argentina -0.7% (+1.2%), Denmark -1.5% (-1.7%), India -1.7% (-0.6%), China -2.3% (-3%), Thailand -4.3% (-6.1%), Malaysia -4.9% (-5.2%), and Philippines -11% (-10.2%).

Panic: “We can no longer squander our strengths with self-imposed handicaps,” wrote Christine Lagarde and Ursula von der Leyen in a FT opinion piece [here] titled: Europe has got the message on change. “There is too much at stake,” continued the ECB and European Commission presidents, hoping to reassure voters and investors that help is on the way from policy makers and politicians. “We are ready to do whatever is necessary to bring Europe back on track,” they wrote in closing, channeling Draghi’s ‘whatever it takes’ speech that saved the Euro in 2012.

Panic II: “While a global revolution in artificial intelligence unfolds, the EU could find itself on the sidelines. Our traditional manufacturing champions are losing global market share. Geopolitical shifts are turning dependencies into vulnerabilities and burdening our companies with high energy prices,” wrote Lagarde and von der Leyen. They pledged to make Europe an easier place for innovative companies to grow. That’s good, because no aspiring entrepreneur has moved to Europe for 100yrs, and many ambitious, innovative young Europeans flee to the US.

Panic III: Markets tend to rally when policy makers and politicians panic. The Euro Stoxx 50 index has been rising and now sits just below the April 2000 highs. The S&P 500 is presently 300% above the equivalent highs from 25yrs ago. It has taken far too long for the Europeans to panic. A war in Ukraine was insufficient, Russia’s nuclear threat too. A pandemic, an energy crisis. Presumably the rise of the far right across a growing group of countries is the catalyst. And of course, the question is whether the incumbent elite is even capable of delivering change?

Stress: Europe is not alone in fighting for its survival. The global trading system faces challenges unlike any it has faced since the end of WWII. The WTO, IMF, and World Bank are all likely to emerge as changed institutions over the next few years. The UN is likely to undergo change. Then there’s NATO and so many other alliances. Political systems, economic too. Global norms. So many of the institutions we have taken for granted will come under stress. Most will bend, some will break, and those that endure will emerge stronger. Stress makes us so.

Stress II: The opinion piece by Lagarde and von der Leyen points the way to what we should expect in the quarters and years to come. When faced with existential threats, those in power across the globe will race to boost output, productivity, prosperity, jobs, safety, security, whatever it is that their increasingly restless populations are crying out for. In general, those things all cost money and are best advanced by stimulus, deregulation, animal spirits. Austerity doesn’t help. So, expect incumbent governments to panic, spend more and tax less. Fighting for survival.

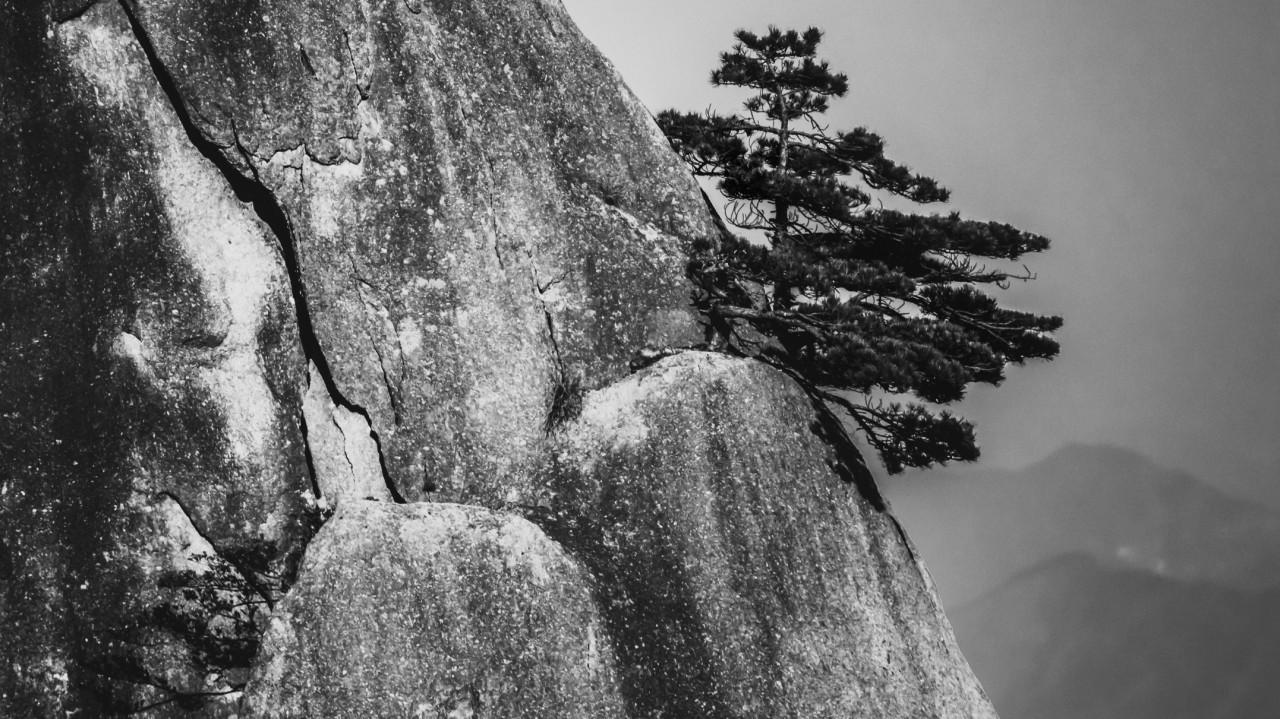

Anecdote: Headed straight up. Skis on, skinning, the snow hard, air cold, a blue sky. Ascending at altitude is always difficult with sea level lungs, but there’s no better way to acclimatize. Heart pounding, lungs burning, thoughts swirling, movement allows us to think clearly, see vividly. At 1000 feet up I turned to look out, Tetons in the distance, the valley floor vast, for the most part untouched, beauty preserved. Spread across the plain were ten thousand dark dots, wild elk, which descend each winter in search of food, refuge from the bitterest cold, violent winds, optimizing for each variable, in an existential struggle with nature. Wolves and coyotes hunt the old, the young, the weak, prowling the herd’s outer edge, a brutal balance, heartbreaking, breathtaking, harmony. I’d just wrapped up a zoom with one of Wall Street’s most insightful geopolitical thinkers, discussing the world’s shifting power structures, the calculations taking place across the political and economic elite in the wake of Trump’s 2nd victory. The world is in search of a new balance and is shifting in ways and at speeds that resemble no other period in human history. The life and death race for AGI. China, Xi, Taiwan, North Korea. Europe and its flawed union, its half measures, helplessness. The UK wandering alone, weak. Germany, on the precipice of making a miscalculation in its dealing with the US. Ukraine, Russia, the growing possibility of protracted low-level conflict. The Middle East, Israel, the Emiratis, Saudi Arabia, the prospect of some sort of grand deal. Yemen, the Houthis. Iraq, its Shia militias. The prospect of an all-out attack on Tehran’s weapons program now that the Ayatollah is largely defenseless, friendless. Energy supplies, infrastructure, trade. Canada, Mexico, Greenland, Panama. The global south. Climate change and its cousin, mass migration. On the zoom were a handful of folks like me, listening, asking, calculating, searching for opportunities, risks, rewards. All in competition, engaged in a game of survival. And I turned away from the valley, back toward the summit.

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.