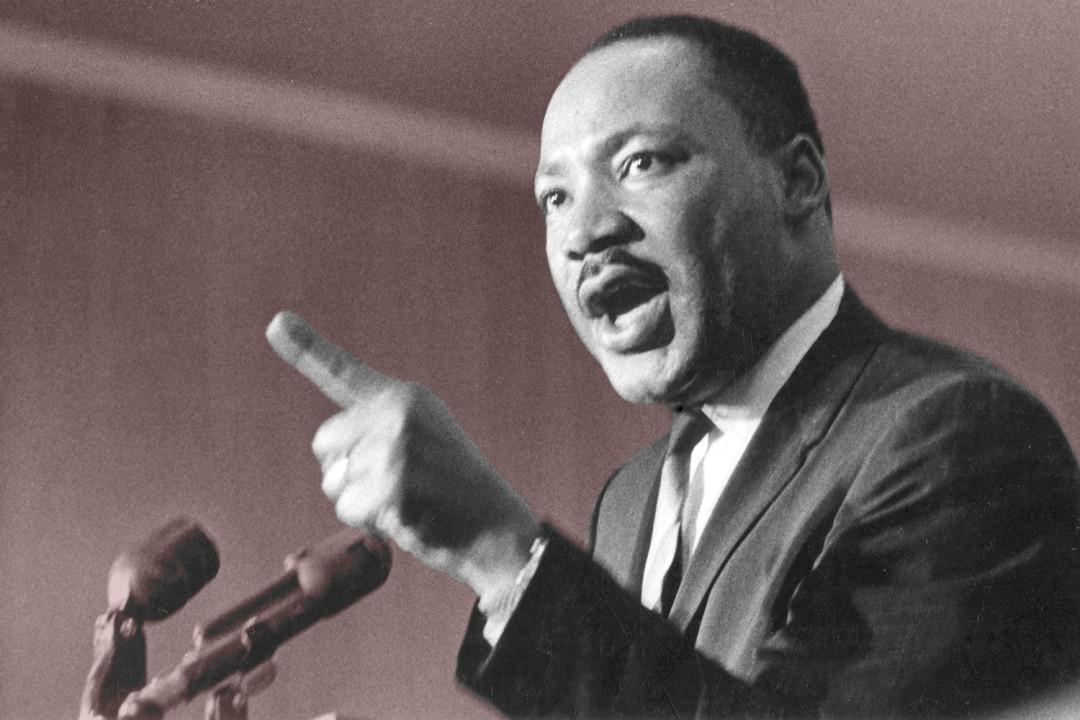

Snuck off to the mountains for long weekend, some altitude, skiing. Dusted off an anecdote from 2018 in honor of Martin Luther King Jr. (see below). Back next Sunday with full weekend notes.

Marcel Kasumovich, Deputy CIO of One River Digital, wrote an excellent piece on Ethereum, evaluating assets based on how they weather market crashes, and positive catalysts on the horizon [click here].

Week-in-Review (expressed in YoY terms): Mon: Bolsonaro supporters break into supreme court / presidential palace in Brazil, Fed’s Bostic sees rates above 5% and staying there, Fed’s Daly open to 25 or 50bp at next meeting, storm leaves 500k homes without power across CA, GS to cut 3200 jobs, Italy unemp 7.8% as exp, EU unemp 6.5% as exp, EU investor conf -17.5 (-18e), Mexico CPI 7.82% (7.84%e) / Core CPI 8.35% as exp, US cons credit 27.962b (25b exp), S&P -0.1%; Tue: China suspends visa issuance to Japanese & S. Korea travelers in retaliation for covid related travel restrictions on Chinese travelers, Yellen to stay as Treasury secretary, ECB’s Schnabel says rates have to rise significantly to bring inflation down in a timely manner, classified documents discovered in Biden’s post VP office, Japan Tokyo CPI 4% as exp / Core CPI 4% (3.8%e), Japan household spending -1.2% (0.5%e), China new loans 1.4t (1.2t exp) / M2 11.8% (12.3%e), Turkey unemp unch at 10.2%, US NFIB 89.8 (91.5e), Brazil IPCA 5.79% (5.6%e), S&P +0.7%; Wed: ECB’s Villeroy says ECB needs to be pragmatic on speed of hikes (terminal by summer), ECB’s Holzmann needs to see a slowdown in core infl to shift stance, Russia to buy Yuan for sov wealth fund, Gundlach says bonds more attractive than equities, FAA system error causes all US flights to be grounded for hours before recovering, Feds’ Collins says hiking by 25bp 3x seems reasonable, Australia CPI 7.3% (7.2%e) / Trimmed mean CPI 5.6% (5.5%e), Japan leading index 97.6 as exp, S&P 1.3%; Thur: US CPI exactly as exp / CPI 6.5% / Core CPI 5.7%, report suggest BoJ will review the side effects of its monetary easing program at next week’s meeting, China hasn’t updated its daily covid reports for 3 days, Fed’s Harker supports 25bp hikes going fwd, Fed’s Bullard wants to get to 5.1% as soon as possible, Fed’s Barkin says infl slowing and rate path will be higher and longer to ensure infl returns to target, Biden’s aides found another cache of classified documents in his garage of his home in Delaware, China CPI 1.8% as exp / PPI -0.7% (-0.1%e), India IP 7.1% (2.8%e) / CPI 5.72% (5.9%e), US init claims 205k (215k exp), S&P +0.3%; Fri: BoJ defended ycc when 10y yields jumped to 54.9bp – pushing yields back to 50bp with a second unscheduled bond operation / market moves to price end of NIRP at next week’s BOJ meeting, BoK hikes 25bp as exp / didn’t rule out more hikes, TSLA cuts price of Model 3 and Y, Japan PM Kishida meets with Biden, US banks kick off earning season, SEC sued crypto brokerages Genesis and Gemini, Brazil’s fin min Haddad unveils plan to cut deficit to bw 0.5%-1.0% this year, Argentina CPI 94.8% (94.9%e), China trade bal 78.01b (76.9b exp) / expts -9.9% (-11.1%e) / impts -7.5% (-10%e), Sweden CPI 12.3% (12%e) / CPIF 10.2% (9.8%e), Hungary CPI 24.5% (25.8%e), Germany 2022 GDP 1.9% (1.8%e), EU IP 2% (0.8%e), EU trade bal -15.2b (-21b exp), Brazil eco activity 1.65% (2.25%e), US impt prices 3.5% (2.2%e) / expt prices 5% (7.3%e), US UofM 64.6 (60.7e) / 1y infl exp 4% (4.3%e) / 5-10y infl exp 3% (2.9%e), Russia CPI 11.94% (12.2%e) / Core CPI 14.31% (15.06%p), S&P +0.4%.

Weekly Close: S&P 500 +2.7% and VIX -2.78 at +18.35. Nikkei +0.6%, Shanghai +1.2%, Euro Stoxx +1.8%, Bovespa +1.8%, MSCI World +3.2%, and MSCI Emerging +4.2%. USD rose +0.4% vs Turkey. USD fell -12.5% vs Bitcoin, -11.5% vs Ethereum, -6.0% vs Russia, -3.2% vs Yen, -3.1% vs Indonesia, -2.5% vs Chile, -2.3% vs Brazil, -2.0% vs Mexico, -1.9% vs China, -1.7% vs Euro, -1.7% vs India, -1.6% vs South Africa, -1.3% vs Australia, -1.2% vs Sweden, -1.1% vs Sterling, and -0.4% vs Canada. Gold +2.8%, Silver +1.6%, Oil +8.3%, Copper +7.8%, Iron Ore +6.7%, Corn +3.2%. 10yr Inflation Breakevens (EU -5bps at 2.08%, US -2bps at 2.19%, JP -9bps at 0.66%, and UK -5bps at 3.37%). 2yr Notes -2bps at 4.24% and 10yr Notes -6bps at 3.51%.

2023 Year-to-Date Equity Indexes (high-to-low): Argentina +17.1% priced in US dollars (+19.8% priced in pesos), Mexico +14.9% priced in US dollars (+10.5% priced in pesos), Ireland +11.1% in dollars (+9.9% in euros), South Africa +10.7% in dollars (+9.3% in rand), Euro Stoxx 50 +10.6% (+9.4%), Italy +9.9% (+8.8%), HK +9.8% (+9.9%), Netherlands +9.8% (+8.6%), France +9.7% (+8.5%), Germany +9.5% (+8.4%), Spain +9.1% (+7.9%), Korea +8.8% (+6.7%), Sweden +8.7% (+8.5%), Russia +8.2% (+2.1%), Poland +8% (+7.1%), Belgium +7.6% (+6.5%), Colombia +7.5% (+4%), Czech Republic +7.4% (+5.7%), Philippines +7.4% (+5.9%), Russell +7.1%, Hungary +7.1% (+5.3%), China +6.5% (+3.4%), Taiwan +6.4% (+4.9%), Austria +6.4% (+5.2%), Australia +6.4% (+4.1%), UK +6.2% (+5.3%), Thailand +6.1% (+0.8%), Canada +6% (+5%), NASDAQ +5.9%, Greece +5.3% (+4.2%), Finland +5.3% (+4.1%), Israel +5.1% (+1.9%), MSCI World +5.1% priced in dollars, Portugal +5.1% (+3.9%), Brazil +4.9% (+1.1%), Switzerland +4.7% (+5.2%), S&P 500 +4.2%, Singapore +2.8% (+1.3%), New Zealand +2.8% (+2.5%), Japan +2.7% (+0.1%), Saudi Arabia +2.6% (+2.5%), Denmark +1.6% (+0.5%), Malaysia +1.6% (0%), India +0.9% (-0.8%), Chile +0.9% (-2%), UAE 0% (0%), Indonesia -0.6% (-3%), Norway -0.7% (-0.2%), Turkey -9.9% (-9.5%), Venezuela -12.7% (-3.4%).

Anecdote (Jan 2018): “Capitalism does not permit an even flow of economic resources. With this system, a small privileged few are rich beyond conscience, and almost all others are doomed to be poor at some level,” said the preacher. “That’s the way the system works. And since we know that the system will not change the rules, we are going to have to change the system,” vowed Martin Luther King Jr. Naturally, this quote is not one of the fifteen engraved into his DC memorial. “Property is intended to serve life, and no matter how much we surround it with rights and respect, it has no personal being. It is part of the earth man walks on. It is not man,” said the subversive, under constant FBI surveillance. The quote didn’t make his memorial either. “Of all the forms of inequality, injustice in health care is the most shocking and inhumane.” Didn’t make it. But this one did: “Injustice anywhere is a threat to justice everywhere. We are caught in an inescapable network of mutuality, tied in a single garment of destiny. Whatever affects one directly, affects all indirectly.” You see, it’s easier for us to admire words of wisdom than to agree on how we attain their ideal. MLK was assassinated in 1968. White unemployment was 3.0%, the cycle low. African American unemployment was double that rate. 1968 inflation was 4.7% – the year prior it was 3.0%, a year later 6.2% – cycle turns are volatile. Today, roughly 50% of Americans with a high school or lesser education remain out of the workforce. It is at once the source of profound inequality, the mechanism by which it becomes entrenched, and the obstacle to tackling it. “Rarely do we find men who willingly engage in hard, solid thinking. There is an almost universal quest for easy answers and half-baked solutions. Nothing pains some people more than having to think.”

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.