Spent the week in Kuwait, Abu Dhabi, Dubai. Epicenter for some of the big themes emerging in the energy transition, emerging market resurgence, global capital flows, reserve currency warfare (digital asset regulation, too). And back here at home base, Marcel Kasumovich, our Head of Research and Deputy CIO for the digital business, was also exploring ideas in energy transition. Ironies too. What follows in today’s edition of wknd notes is pure Kasumovich.

Overall: “We delivered record earnings and cash flow in 2022, while increasing investments and growing U.S. production to a company record,” said Chevron CEO Mike Wirth. “We are well positioned to lead in both traditional and new energy businesses, delivering higher returns, lower carbon, and superior shareholder value.” The market rejoiced in the $75bln share buyback program, ushering in a new era for oil producers. In the past, commodity leaders were rewarded for production. Strong profits were followed by even stronger investment. Low-cost producers gained market share by leveraged buyouts of smaller higher-cost ones. Not today. CEOs are incentivized by profitability, and the era of climate policies reinforces the goal. Politicians don’t like it, naturally. Abdullah Hasan’s message on behalf of the White House was blunt: “For a company that claimed not too long ago that it was 'working hard' to increase oil production, handing out $75 billion to executives and wealthy shareholders sure is an odd way to show it.” Policy signals are clear – climate change demands an energy transition. But the world needs an offramp, and none has been offered. So, it is being imposed by the market in the most brutal of manners. It is the unintended consequence, generating geopolitical strife. “Transmission lines tripped, which resulted in isolation of north and south system,” wrote Sajjad Akthar, general manager at Pakistan’s state-run National Transmission and Distribution Company. Complete grid failures are rare. Operators of modern grids observed shocks from integration of renewable energy as their primary challenge. Pakistan’s blackout last week was its second near-complete grid failure and the third in south Asia in three months. 220 million people were impacted. “Due to unavailability of generators, services are affected in health centers in suburbs,” Dr. Imran Zarkoon declared, the director of a local health department. It is also not a shock. Prime Minister Sharif already ordered all federal departments to reduce their energy consumption by 30% earlier in the month. Italian energy major Eni also notified it would not deliver an LNG cargo to Pakistan due to circumstances outside its control. Eni has a long-term contract to deliver one LNG cargo per month to Pakistan through 2032. “All the previous disruptions in LNG delivery suffered by ENI have been caused by the LNG supplier who didn’t fulfill the agreed obligations,” the company said. “At the request of the authorities, an in-person Fund mission is scheduled to visit Islamabad,” the IMF’s Resident Chief stated. Negotiations for unlocking the $1.1bln IMF tranche come after FX companies removed a floor for the currency, opening the door for a 10% decline. And it is all in an election year with Beijing Islamabad’s chief supporter. The China-Pakistan Economic Corridor is an elaborate, 3000-kilometer infrastructure project covering sea and land, securing passage for China’s energy imports. So, it’s complicated. It always is. Just as the weakest links are always the first to reveal distress.

Marcel Kasumovich, Deputy CIO of One River Digital, discussed the regulatory crossroads for digital assets in this week’s piece [click here]. Like the growth in the Eurodollar market, policy choices could drive innovation to new financial hubs.

Week-in-Review: Mon: Lunar New Year begins across many Asian countries, BOJ see’s strong demand for its 1T yen of 5y loans (new “LTRO”-like program), ECB’s Knot calls for consecutive 50bp hikes / time to slow pace of hikes is ‘still far away,’ ECB’s Kazimir backs two more 50bp hikes, ECB’s Nagel says bank will return infl to target without causing recession, ECB’s Rehn sees ‘significant’ hikes before summer, NZ labour party selects Chris Hipkins to succeed outgoing Jacinda Ardern as PM, Argentina/Brazil in preliminary stages of discussions to form a common currency, Erdogan says Sweden shouldn’t expect Turkey’s support in NATO bid, US White House confronts China with evidence that some state-owned enterprises are aiding Russia in its war against Ukraine, US leading index -1% MoM (-0.7%e), EU cons conf -20.9 (-20e), S&P +1.2%; Tue: ECB’s Panetta says shouldn’t pre-commit to any specific moves, ECB’s Simkus says unlikely to reach peak rate before summer / more 50bp hikes, DOJ’s to sue Google over digital ad dominance, Poland requests permission from Germany to send Leopard tanks to Ukraine, BOJ data confirms it holds greater than 100% of the CTD bond for the JBH3 contract, Yellen suspends investment into “G Fund” in latest use of extraordinary measures, MSFT whipsaws after positive earnings but weak guidance for its cloud business, Walmart to hike wages 17% for lowest earners, NYSE computer glitch creates issues during the open, Germany cons conf -33.9 (-33.3e), UK Public borrowing 27.4b (17.3b exp), EU flash PMIs mfg 48.8 (48.5e) / serv 50.7 (50.1e) / comp 50.2 (49.8e) – first print above 50 since June, Brazil IPCA infl 5.87% (5.83%e), US S&P flash PMI mfg 46.8 (46e) / serv 46.6 (45e) / comp 46.6 (46.4e), US Richmond Fed -11 (-5e), S&P -0.1%; Wed: BOC hikes 25bp / signals end of hiking cycle, US/Germany agree to send tanks to Ukraine, US nat gas prices drop below $3 for first time in 19m, TSLA beats earnings, New Zealand CPI 7.2% (7.1%e) / Core CPI 1.5% (1.75e), Australia CPI 7.8% (7.6%e) / trimmed mean CPI 6.9% (6.5%e), Singapore CPI 6.5% (6.6%e) / Core CPI 5.1% (5%e), UK PPI 16.2% (16.4%e), Sweden PPI 18.7% (19.5%p), Germany IFO 90.2 (90.3e) / IFO exp 86.4 (85.3e), US mortgage apps 7% WoW (27.9%p), S&P unch; Thu: US 4Q GDP 2.9% (2.6%e) / Core PCE 3.9% QoQ as exp / Personal consumption 2.1% (2.9%e), S. Africa CB hikes 25bp (50bp exp) / cuts growth forecast, IMF suggests BOJ should look to offer more flexible long-term yields, Turkey to offer favorable exch rate to exporters if they keep converted ccy in Lira for some time, 7y auction in US continues trend of very strong treasury demand, EU is considering capping Russian diesel at $100/b, S. Korea 4Q GDP 1.4% (1.3%e) / 2022 GDP 2.6% (2.5%e), Philippines 4Q GDP 7.2% (6.6%e) / 2022 7.6% (7.4%e), US init claims 186k (205k exp), US durable goods 5.6% MoM (2.5%e), US new home sales 616k (612k exp), US KC fed mfg activity -1 (-8 exp), S&P +1.1%; Fri: Japan/Netherlands agree to join US in China chip curbs, Intel/Amex/Chevron earnings soft, rumors that US House Republicans are proposing an extension of the debt limit until the end of Sept, UK Chancellor Hunt dismissed calls for tax cuts, Tokyo CPI 4.4% (4%e) / Core CPI 3% (2.9%e), Spain 4Q GDP 2.75 (2.2%e), EU M3 4.1% (4.6%e), US PCE 5% as exp/ Core PCE 4.4% as exp, US Pending Home sales -34.3% (-35.4%e), US UofM 64.9 (64.6e) / 1y infl exp 3.9% (4%e) / 5-10y infl exp 2.9% (3%e), US KC Fed -11 (-5p), S&P +0.3%.

Weekly Close: S&P 500 +2.5% and VIX -1.34 at +18.51. Nikkei +3.1%, Shanghai +0.0%, Euro Stoxx +0.7%, Bovespa +0.2%, MSCI World +2.2%, and MSCI Emerging +1.4%. USD rose +1.0% vs Russia, +0.5% vs India, +0.3% vs South Africa, +0.2% vs Yen, +0.2% vs Turkey, +0.1% vs Sweden, and +0.1% vs Sterling. USD fell -8.2% vs Bitcoin, -1.9% vs Australia, -1.9% vs Brazil, -1.3% vs Ethereum, -1.1% vs Chile, -0.6% vs Indonesia, -0.6% vs Mexico, -0.5% vs Canada, -0.1% vs Euro, and flat vs China. Gold +0.0%, Silver -1.3%, Oil -2.4%, Copper -0.7%, Iron Ore +0.0%, Corn +1.0%. 10yr Inflation Breakevens (EU +11bps at 2.13%, US +8bps at 2.32%, JP +11bps at 0.74%, and UK +3bps at 3.37%). 2yr Notes +3bps at 4.20% and 10yr Notes +2bps at 3.51%.

Year-to-Date Equities (high to low): Argentina +20.1% priced in US dollars (+25.8% priced in pesos), Mexico +17.5% priced in US dollars (+13% in pesos), HK +14.3% in US dollars (+14.7% in HK dollars), Ireland +13.9% in dollars (+12.3% in euros), Czech Republic +13.9% (+10.8%), Korea +13.9% (+11.1%), Italy +13.1% (+11.5%), Euro Stoxx 50 +11.7% (+10.1%), Spain +11.7% (+10.1%), France +11.2% (+9.6%), NASDAQ +11%, Australia +10.9% (+6.5%), South Africa +10.8% (+11.7%), Greece +10.8% (+9.2%), Hungary +10.6% (+6.5%), Netherlands +10.5% (+8.9%), Germany +10.4% (+8.8%), Austria +9.4% (+7.9%), Philippines +9.4% (+7.4%), Canada +8.7% (+6.9%), Sweden +8.7% (+7.5%), Russell +8.5%, Poland +7.5% (+6.6%), China +7.5% (+5.7%), New Zealand +7.2% (+4.9%), Chile +7.1% (+1.7%), Taiwan +7.1% (+5.6%), MSCI World +7% priced in US dollars, UK +6.7% (+4.2%), Russia +6.7% (+1.6%), Singapore +6.5% (+4.4%), Thailand +6.3% (+0.8%), Brazil +6% (+2.4%), S&P 500 +6%, Colombia +6% (0%), Belgium +5.9% (+4.4%), Japan +5.8% (+4.9%), Switzerland +5.7% (+5.6%), Finland +5.5% (+4%), Indonesia +4.3% (+0.7%), Malaysia +4% (+0.1%), Saudi Arabia +3.4% (+3.3%), Portugal +2.9% (+1.4%), Israel +2.7% (-0.3%), Denmark +1.3% (-0.1%), Norway -0.2% (+0.4%), India -1.4% (-2.8%), Venezuela -4.5% (+13.7%), UAE -4.6% (-4.6%), Turkey -6.2% (-5.8%).

Irony: “All of us are smarter than any of us,” declared Jawad Mian, leaving no room for dissent. Jawad is an independent thinker and lives it as Managing Editor of Stray Reflections. Building anything is hard. It takes the courage of conviction in yourself yet the humility to respect the high odds of failure. It’s the height of irony – having the courage to fail. Builders elevate the energy of everybody in their orbit, constantly exploring, hunting for the next adventure. It’s called living. Jawad guides conversations with command of issues, probing conviction. And irony checkered a recent roundtable discussion with Jawad and friends.

Irony II: “We are worried about inflation,” the fearless leader observed, met with frantic nods. Investors are taking little solace in inflation’s sharp deceleration. The Fed’s preferred inflation measure, core PCE, slowed to 2.9% annualized in the past three months, below 3% for the first time in two years. Long-term inflation expectations have been a rock. But inflation fears linger. “Portfolios need insurance, and it’s hard to find. Curves are inverted. Maybe it’s cash?” How the world has changed when short-term paper is contemplated as a tool for protecting against inflation. And if the Fed keeps real rates high – it works.

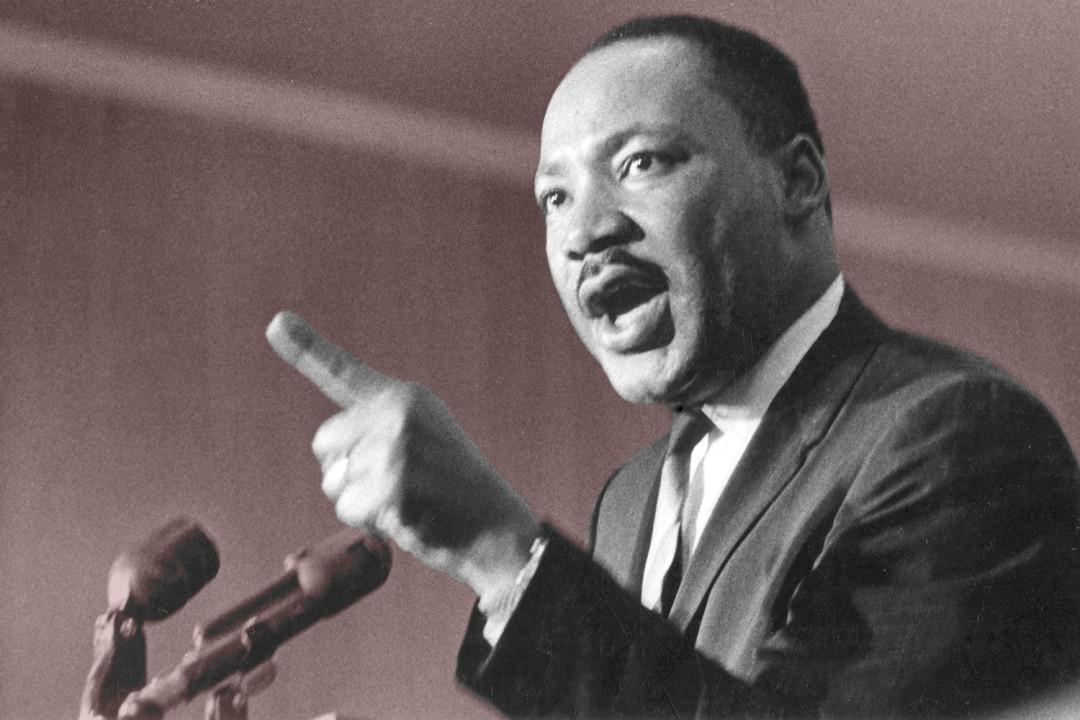

Irony III: “Balance sheets are invisible to policymakers and investors alike – the gorilla in the room,” chimed the cautious strategist. Fiscal policy is the fox dressed in sheep clothes – it’s not all about the Fed. Arthur Burns understood it well: “Monetary policy is much too blunt to bring inflation under control. It is of vital importance that fiscal policy actively joins in the battle,” he challenged Congress in 1974. A weaker dollar reflects inflation fears – a quiet decline with declarations that it can’t go lower only to see it go ever lower. “That’s the solution to US balance sheets,” the strategist planted.

Irony IV: “So, investors need insurance, worry about inflation – and are long US dollar,” observed Jawad questioning the irony. No emerging market investor would dare to think of monetary policy divorced from fiscal policy. Orthodoxy is only as strong as its weakest link. The outperformance of US assets over emerging markets was epic in the past decade. Over a ten-year period where the S&P 500 Index rose 2.5-times, Emerging Markets were flat. Long US software was the theme. Software is the inflation killer, not the cause. That trend is over. Now, global markets are loving the weaker dollar. Love beats hate.

Irony V: “Every decade has a Zeitgeist,” Jawad offered with a visual. “From gold in the 1970s to software in the 2010s,” he patiently documented. “What is it this decade?” he demanded. Climate. And climate policy can justify higher inflation. Inflation rations demand and helps the planet – it’s a generational investment. Let’s give it a name – Greenflation. But the commodity complex wins. The problem is the solution. Chevron announced $75bln of stock buybacks last week, more than 20% of its market cap. Conventional energy investment doesn’t boom – so its price does. Oil is portfolio insurance?!

Irony VI: “Gold. Not oil. Gold. Gold has a long history, it stands the test of time,” a consensus emerges. And it’s true. Monetary history is comfort food for investors. Yet, gold is the irony of all ironies. Gold is a remarkably efficient conductor. It can be thinned to stretch around the world multiple times without losing that property. Literally. But investors increased the value of gold to the point where it is unusable for its most useful purpose. Copious amounts of energy are spent to get gold out of the ground, its purity is lessened transforming it into a bar, and investors put its beauty back in the ground. Gold it is. Maybe.

Irony VII: You can’t think about portfolio insurance without images of Black Monday. Portfolio insurance was the instability, investment irony at its finest. “It is a variant of the old Luddite fallacy of blaming modern technology,” argued philosopher Murray Rothbard after the crash. It parallels to digital gold today – bitcoin. “Bitcoin is the strongest performing asset from the pandemic lows” Jawad offered. “The market is telling us something.” US policy is moving away from digital financial innovations, assuming it is left for dead. Be skeptical, but not dismissive. After all, irony is only defined after the facts.

Anecdote: “If humanity does not fail nature, nature will not fail us,” October 28, 2022. Who said it? No, not Al Gore. Greta gave it a thumbs up, but it wasn’t her. It was President Xi in his unveiling of China’s White Paper on Climate Change. Climate is poised to dominate investment in the next decade. A wide-ranging survey showed 53% of investors regard climate change as the most important factor affecting their investment decisions; 78% of private and business clients surveyed are concerned about climate change; these echo in the chambers of the WEF, focused on “staving off disaster and catastrophe.” Herds are famous for stampeding principled contrarians in financial markets. Investors are asked to be wise enough to see the follies of the collective and disciplined enough to not get run over by the herd. Irony is the answer. Global CO2 emissions have increased 44% in the past two decades – China accounts for 68% of the world’s rise. Climate goals without capital discipline won’t matter. This is also where it pays to avoid the herd, who are dedicated to hopelessly inefficient solutions. China accounts for more than one-third of global commodity production – cutting raw material output is the only way of achieving Beijing’s ambitious climate goals. Raw materials will be in high demand through the world’s energy transition. Those will also be shorter in supply. China is preparing, the world is talking, and markets are the arbiter with high prices accelerating the energy transition. And in that transition shines the most ironic climate theme. Long oil.

Good luck out there,

Marcel Kasumovich

Deputy Chief Investment Officer

One River Digital Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.