“President Biden Issues Executive Order on Safe, Secure, and Trustworthy Artificial Intelligence,” announced the White House homepage in large, bold font [here]. It’s a rather weak name for such an important order, probably the product of a committee, or some first-year McKinsey consultant. So, I asked GPT-4 for a new name, perhaps biblical, playing on the theme of Eve and the forbidden fruit from the tree of knowledge, or maybe something Orwellian, like the deficit-fueled extravaganza they called the Inflation Reduction Act. And GPT-4 suggested the “AGI Safety Act.”

Overall: “Imagine a technological breakthrough that will give its inventor power over humanity and can be used for both extreme evil and good,” I asked GPT-4. The Bletchley Declaration – a pledge of international cooperation in the quest to regulate frontier Artificial Intelligence - had just been signed by 28 nations, including the US, China, Japan, the EU, UK, India, Brazil, Canada, Australia, UAE, and Saudi Arabia [here]. “Assume many players are investing massively to be first to make the breakthrough,” I continued typing in GPT-4’s neural interface. “Will it be possible to coordinate their behaviors so that the breakthrough is used for good and spread across humanity in a way that is fair to all?” I asked. “And how can this be possible, when the risks of losing this competition are potentially existential, while the rewards are so great?” I was just curious. OpenAI’s Sam Altman was at the UK’s Bletchley conference, as was Elon Musk, Salesforce’s Benioff, Google’s Manyika and Hassabis, and Arm’s Haas. Each major government had senior representatives. Naturally, Putin couldn’t make it. Nor any Ayatollahs. And the North Korean kid can’t stomach long train trips. “Achieving coordination among competing players for the common good, especially when the stakes are incredibly high, is indeed a challenging endeavor. However, with the right combination of diplomacy, strategic planning, and incentives, it might be possible. Here's a strategy to navigate such a situation,” answered GPT-4. It gave me a sensible ten-point plan that humanity has used to address nuclear proliferation. I asked if there are other examples. GPT-4 highlighted the human genome project, ozone layer depletion, climate change via the Paris Agreement, and global health emergencies via the WHO which I think must have been a joke. And this suggests that in all human history, there is just one example, which was our unsuccessful effort to prevent a nuclear arms race. Which is surely the direction the AGI sprint is headed. And GPT-4 reluctantly agreed.

Week-in-Review: Mon: Israeli ground invasion into Gaza began over the weekend / Netanyahu under pressure for not taking responsibility of 10/7 attack, GM said to reach agreement with UAW – effectively ending the strike, ECB’s Vujcic says done hiking for now / Kazimir says talks of 1H ’24 cuts ‘entirely misplaced’, Pence drops out of 2024 presidential race, US treasury tweaks borrowing estimates (lower Q4 / higher Q1), Brazil's FinMin Haddad failed to reassure the market that the gov would be able to deliver its 2024 zero-deficit target, Sweden 3Q GDP -1.2% (-0.8%e), Germany 3Q GDP -0.8% (-1%e), Germany CPI 3.0% (3.3%e), Spain CPI 3.5% (3.8%e), US Dallas Fed mfg activity -19.2 (-16.0e), S&P +1.2%; Tue: BoJ announced 1% the new reference rate with no hard cap / kept the easing bias / raised CPI forecasts significantly (2024: 1.9% --> 2.8%), MOF did NOT intervene in October, Iran’s foreign minister says ‘we need to use the last political opportunities to stop the war’, Japan unemp 2.6% as exp / ret sales 5.8% (5.9%e) / IP -4.6% (-2.3%e) / housing starts -6.8% (-6.4%e), China mfg PMI 49.5 (50.2e) / serv 50.6 (52e) / comp 50.7 (52p), France CPI 4.5% as exp, Taiwan 3Q GDP 2.32% (2%e), H. Kong 3Q GDP 4.1% (5.2%e), Italy 3Q GDP 0% (0.1%e), EU 3Q GDP 0.1% (0.2%e), EU CPI 2.9% (3.1%e) / CPI core 4.2% as exp, Mexico GDP 3.3% (3.2%e), Canada Q3 GDP 0.9% as exp, US employment cost index (3Q) 1.1% (1%e), US C/S home prices 2.57% (1.78%e), US Chicago PMI 44.0 (45.0e), US Cons conf 102.6 (100.5e), S&P +0.6%; Wed: Fed unch as exp / acknowledges the recent rise in FCI allows them to be cautious / Powell reiterates data dependency but market interprets that to mean Fed likely done (given pessimistic outlook on data), US treasury quarterly refunding shows increase in bill issuance amid higher term premia out the curve, MOF top ccy official says JPY moves are not in line with fundamentals, BOJ conducts unscheduled rinban operation as 10y touches 0.97%, reports that Kishida administration to announce ~22T JPY stimulus package, BCB cuts 50bp as exp, China Caixin PMI mfg 49.5 (50.8e), UK Nationwide house Px -3.3% (-4.8%e), UK PMI mfg 44.8 (45.2e), US ADP emp chg 113k (150k e), US JOLTS job openings 9.553m (9.4m exp), US PMI mfg 50.0 as exp, US ISM mfg 46.7 (49.0e) / Prices paid 45.1 (45.0e), S&P +1.0%; Thu: BoE unch as exp / details skew hawkish, Apple says iPhone sales in China lower than exp, Israel attacked from the north by Hezbollah in 19 locations, Germany unemp 5.8% as exp, EU mfg PMI 43.1 (43e), US Unit Labor Cost 3Q -0.8% (0.3%e) / productivity 4.7% (4.3%e), US Initial claims 217k (210k e) / Continuing claims 1818k (1800k e), US Factory orders 2.8% (2.3%e) / Durable goods orders 4.6% (4.7%e), S&P +1.9%; Fri: NFP 150k (180k exp) / unemp 3.9% (3.8%e) / AHE 4.1% (4%e), Hezbollah leader Nasrallah makes threats but does not commit to broader war in first public appearance since the 10/7 attacks, SBF convicted on all counts of fraud / conspiracy, Blinken arrives in Tel Aviv, ECB’s Schnabel says another hike cannot be excluded, China Caixin serv PMI 50.4 (51e) / comp 50 (50.9p), Turkey CPI 61.36% (62.50%e) / Core 69.76% (70.90%e), Italy unemp 7.4% as exp, EU unemp 6.5% (6.4%e), Canada emp chg 17.5k (25.0k e) / unemp 5.7% (5.6%e), US ISM serv 51.8 (53e) / prices paid 58.6 (56.6e), S&P +1.3%.

Weekly Close: S&P 500 +5.9% and VIX -6.36 at +14.91. Nikkei +3.1%, Shanghai +0.4%, Euro Stoxx +3.4%, Bovespa +4.3%, MSCI World +5.6%, and MSCI Emerging +3.1%. USD rose +0.7% vs Turkey, and flat vs India. USD fell -6.2% vs Chile, -3.6% vs Mexico, -3.1% vs South Africa, -2.7% vs Australia, -2.4% vs Bitcoin, -2.2% vs Sweden, -2.2% vs Brazil, -2.1% vs Sterling, -1.6% vs Ethereum, -1.5% vs Euro, -1.5% vs Canada, -1.3% vs Indonesia, -0.6% vs Russia, -0.6% vs China, and -0.2% vs Yen. Gold +0.0%, Silver +1.7%, Oil -5.9%, Copper +1.0%, Iron Ore +1.5%, Corn -0.7%. 10yr Inflation Breakevens (EU -9bps at 2.17%, US -3bps at 2.40%, JP +10bps at 1.39%, and UK -1bp at 3.78%). 2yr Notes -16bps at 4.84% and 10yr Notes -26bps at 4.57%.

Oct Mthly Close: S&P 500 -2.2% and VIX +0.62 at +18.14. Nikkei -3.1%, Shanghai -2.9%, Euro Stoxx -3.7%, Bovespa -2.9%, MSCI World -3.0%, and MSCI Emerging -3.9%. USD rose +3.6% vs Mexico, +3.2% vs Turkey, +2.8% vs Indonesia, +2.4% vs Sweden, +2.2% vs Canada, +1.5% vs Yen, +1.5% vs Australia, +0.7% vs Chile, +0.4% vs Sterling, +0.3% vs India, +0.3% vs China, and +0.1% vs Brazil. USD fell -21.6% vs Bitcoin, -6.8% vs Ethereum, -5.6% vs Russia, -1.4% vs South Africa, and flat vs Euro. Gold +6.9%, Silver +2.2%, Oil -8.8%, Copper -2.4%, Iron Ore +3.5%, Corn +0.4%. 10yr Inflation Breakevens (EU -9bps at 2.25%, US +8bps at 2.42%, JP +13bps at 1.35%, and UK -9bps at 3.76%). 2yr Notes +4bps at 5.09% and 10yr Notes +36bps at 4.93%.

Year-to-Date Equities (high to low): Turkey +63.9% priced in US dollars (+39.9% priced in lira), Argentina +59.6% priced in US dollars (+215.4% priced in pesos), Venezuela +41.8% priced in dollars (+194.1% priced in bolivars), Hungary +38% (+30.9%), Poland +32.9% (+26.1%), Greece +31.5% (+31.2%), NASDAQ +28.8%, Italy +21.2% (+21%), Mexico +18.3% (+5.8%), Russia +18.1% (+49%), Denmark +17.2% (+17.3%), Ireland +16.6% (+16.3%), Brazil +16.3% (+7.7%), Czech Republic +14% (+15%), S&P 500 +13.5%, Spain +13.2% (+12.9%), Taiwan +11.2% (+16.8%), MSCI World +10.8% in dollars, Euro Stoxx 50 +10.3% (+10%), Germany +9.4% (+9.1%), France +9.1% (+8.9%), Netherlands +7.1% (+6.9%), Japan +6.6% (+22.4%), India +5.7% (+6.2%), Colombia +4.5% (-14.6%), Saudi Arabia +3.8% (+3.6%), Portugal +3.6% (+3.3%), Chile +3.3% (+6.8%), Korea +2.3% (+5.9%), Austria +2.2% (+1.9%), UK +1.9% (-0.5%), Switzerland +1.2% (-1.4%), Canada +1.2% (+2.3%), Russell flat, Sweden -0.5% (+4.1%), Indonesia -1.5% (-0.9%), Norway -3.1% (+9%), Singapore -4.3% (-3.3%), Belgium -5.1% (-5.3%), Australia -5.3% (-0.9%), South Africa -6.6% (-0.1%), UAE -6.9% (-6.9%), China -7.1% (-1.9%), New Zealand -8.6% (-3.1%), Philippines -8.8% (-8.8%), Malaysia -9.6% (-3%), HK -11% (-10.7%), Finland -12.1% (-12.3%), Thailand -16.9% (-14.9%), and Israel -17.1% (-6.2%).

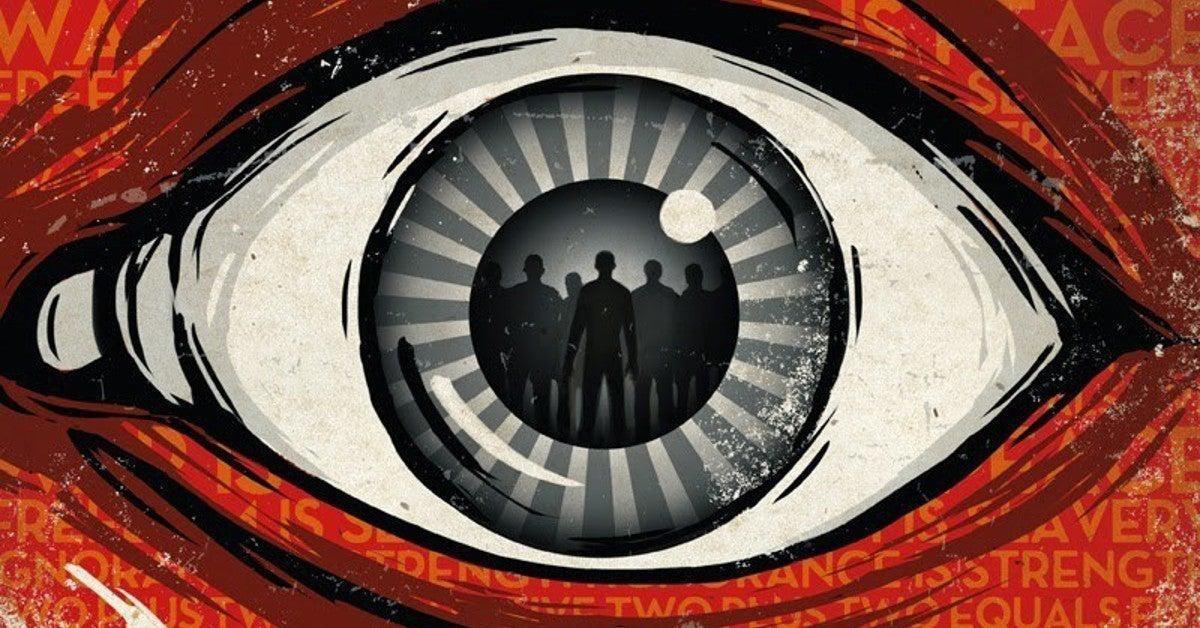

Doublespeak: In 1984, George Orwell wrote: “To know and not to know, to be conscious of complete truthfulness while telling carefully constructed lies, to hold simultaneously two opinions which cancelled out, knowing them to be contradictory and believing in both of them, to use logic against logic, to repudiate morality while laying claim to it, to believe that democracy was impossible and that the Party was the guardian of democracy, to forget whatever it was necessary to forget, then to draw it back into memory again at the moment when it was needed, and then promptly to forget it again, and above all, to apply the same process to the process itself - that was the ultimate subtlety: consciously to induce unconsciousness, and then, once again, to become unconscious of the act of hypnosis you had just performed. Even to understand the word - doublethink - involved the use of doublethink.”

War is Peace: This week’s Bletchley Declaration starts by declaring that “Artificial Intelligence (AI) presents enormous global opportunities: it has the potential to transform and enhance human wellbeing, peace and prosperity.” Surely this is true. “We welcome the international community’s efforts so far to cooperate on AI to promote inclusive economic growth, sustainable development and innovation, to protect human rights and fundamental freedoms, and to foster public trust and confidence in AI systems to fully realize their potential.” It is a sublime sentence, filled with less than no meaning. The US and China signed on.

Ignorance is Strength: The Bletchley Declaration goes on to highlight a wide range of nefarious things that we must prevent AI from being used to do. Which naturally reads like a McKinsey project plan for the R&D projects every bad actor on the planet will surely pursue if they haven’t started already. And this means that all the others will need to beat them to it. No different from gain-of-function research (GOFR). No great nation can afford to be late to the Technological Singularity. If there were ever a chance for a lesser nation to leapfrog a superpower, it is now.

Freedom is Slavery: Vast surveillance systems, combined with powerful AI, will empower those nations so inclined to oppress their citizens in ways that would make a Stasi officer blush. And not even Orwell could have imagined tools to distort the truth and deliver doublespeak at such scale. Of course, this is the massive opportunity for those democracies which limit state power and uphold rule of law in the years ahead - such nations call things by their proper names, honoring the truth. The world’s great talent will seek refuge in them. Get long these nations.

2 + 2 = 5: If you do not live in such a nation, move to one now. And if you’re already in one, make every personal effort possible to strengthen the checks and balances that restrain government and corporate power. After that, figure out how to position oneself to take advantage of the profound advances that will surely arise in coming decades from the advance of AI, while also attempting to avoid the great dislocations ahead. One place to start is to ask GPT-4 how AI will impact various industries, technologies, and means of production. It’s a decent place to start.

Anecdote: “Specialized knowledge that involves creativity, strategy, and complex human interactions is less likely to be commoditized because these areas are more challenging for AI to replicate,” answered GPT-4. “Humans with such expertise may find their skills in higher demand.” Couldn’t agree more. I had asked the AI whether specialized knowledge would be commoditized due to advances in AI. Obviously, the answer is yes, but I was curious to hear GPT-4’s answer. There was a time, eons ago, when few humans had specialized knowledge. The demands of the wild required a wide range of skills focused principally on survival. Now we have neurointerventional radiologists. Niels Bohr, the Nobel Laureate, defined an expert as “a person who has made all the mistakes that can be made in a very narrow field.” Naturally, along humanity’s path to hyperspecialization we produced extraordinary polymaths who sought and then synthesized knowledge across a wide range of subjects. Leonardo Da Vinci with his Mona Lisa and flying machines. Galileo. Newton. Ben Franklin. Albert Einstein. It is possible that such remarkable genius would have drowned in the world we are entering, flooded with easily accessible knowledge at an almost unimaginable depth. Maybe it was the act of insatiable inquiry, deep discovery, and sublime synthesis that allowed them to produce their greatest work. Or perhaps, with the accumulation of all human knowledge acquired since Eve ate the apple, pumped through ever more powerful AIs, they would have advanced our understanding in ways we cannot fathom. We will never know. But it seems likely that in a world where the specialized knowledge so many have devoted their lives to acquiring is becoming commoditized, new kinds of opportunities will open. To lateral thinkers. Those who deploy their energy to understanding a wide range of subjects that to most appear unconnected. Perhaps irrelevant. Those who train themselves to think like polymaths.

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.