Dusted off an anecdote from June 2013 about training to win. I take August off from writing to recharge, read, roam. Hoping the same for you and your crew. See you again on September 11th with full weekend notes. E

Week-in-Review (expressed in YoY terms): Mon: China cuts 1y Loan Prime Rate 0.05% and 5y LPR 0.15%, China plans $29b in special loans to struggling developers, German year ahead power surges to EU700/MWH for first time, Israel CB hikes 75bp (50bp exp), Pfizer submits specific omicron targeting vaccine, EUR falls to lowest level since 2002, Saudi says oil futures “disconnect” may force OPEC+ to act, news of unexpected NS1 closure for three days, key Russian nationalist supporters daughter killed in car bombing, US Chicago Fed activity index 0.27 (-0.25e), S&P -2.1%; Tue: S. Korea says will monitor FX markets and intervene as necessary, US nat gas futures hit $10 for first time since 2008, Julian Robertson passes away (RIP), Iran gives up demand that IAEA investigation be closed, Indonesia hikes by 25bp (no hike exp), Singapore CPI 7% as exp / Core CPI 4.8% (4.7%e), EU mfg PMI flash 49.7 (49e) / serv 50.2 (50.5e) / comp 49.2 (49e), S. Africa unemp 33.9% (35%e), US mfg PMI 51.3 (51.8e) / serv 44.1 (49.8e) / comp 45 (47.7p), EU cons conf -24.9 (-28e), US new home sales 511k (575k exp) / -12.6% MoM (-2.5%e), S&P -0.2%; Wed: China warns banks about excessively shorting CNH, Freeport says LNG terminal delayed until mid Nov (Oct previous expectation), OPEC+ supports Saudi calls for supply cuts, Riksbank’s Floden says SEK too weak / more hikes coming, Japan considers building new nuclear reactor, UK seeing more strikes due to falling real wages, Biden announces student debt forgiveness plan, Fed’s Kashkari reiterated need for more aggressive hikes, S. Africa CPI 7.8% as exp / Core CPI 4.6% (4.5%e), Brazil IPCA infl 9.6% (9.49%e), US durable goods 0% MoM (0.8%e), US pending home sales -22.5% (-21.4%e), Russia IP -0.5% (-2.3%e), S&P +0.3%; Thur: Fed’s Bostic says split between 50 & 75 - more strong data could tip FOMC towards 75bp in Sept / Fed’s Bullard still supports front loading hikes, ECB mins show some members pushed for only 25bp increase, Fed’s George says need to tighten financial conditions, CNH fixing much lower than exp, BoK hikes 25bp as exp, BOJ’s Nakamura reiterates need for persistent monetary easing, Ukraine largest nuclear plant cut off from the grid, S. Korea PPI 9.2% (10%p), Japan PPI Services 2.1% (2.2%e), Germany 2Q GDP 1.7% (1.4%e), France mfg conf 104 as exp, Germany IFO 88.5 (86.8e), HK expts -8.9% (-4.8%e) / impts -9.9% (-0.5%e), S. Africa PPI 18% (17.5%e), Mexico 2Q GDP 2% as exp, US init claims 243k (252k exp), US 2Q GDP (2nd print) -0.6% (-0.7%e) / US personal consumption 1.5% as exp, US KC Fed 3 (10e), S&P +1.4%; Fri: Powell’s Jackson Hole speech sends clear message that rates will likely stay higher for longer, DOJ drafting possible antitrust suit against AAPL, report circulates that some ECB members support 75bp hike in Sept / ECB’s Holzmann subsequently says 75bp should be part of the discussion, RBNZ’s Orr reiterates at least a couple more rate hikes, PBOC continues to fix yuan rate stronger than expected, Iowa’s corn crop outlook underwhelmed / on track to be smallest since 2019, India likely to curb rice exports, FBI’s Trump search affidavit is unsealed – highly redacted, Germany cons conf -36.5 (-32e), Sweden PPI 20.4 (25.6p) / unemp 7% (7.6%e), France cons conf 82 (79e), Italy cons conf 98.3 (92.5e), US wholesale inv 0.8% (1.4%e) / US personal inc 0.2% (0.6%e) / spending 0.1% (0.5%e) / PCE Deflator 6.3% (6.4%e) / Core PCE Deflator 4.6% (4.7%e), US UofM 58.2 (55.5e) / 1y infl exp 4.8% (5%e) / 5-10y infl exp 2.9% (3%e), S&P -3.4%.

Weekly Close: S&P 500 -4.0% and VIX +4.96 at +25.56. Nikkei -1.0%, Shanghai -0.7%, Euro Stoxx -2.6%, Bovespa +0.7%, MSCI World -0.7%, and MSCI Emerging +0.2%. USD rose +2.1% vs Ethereum, +2.0% vs Russia, +0.8% vs China, +0.8% vs Sterling, +0.7% vs Euro, +0.7% vs Sweden, +0.4% vs Yen, +0.4% vs Turkey, +0.3% vs Canada, and +0.1% vs India. USD fell -5.3% vs Chile, -1.8% vs Brazil, -0.7% vs Mexico, -0.7% vs South Africa, -0.2% vs Australia, -0.1% vs Indonesia, and -0.1% vs Bitcoin. Gold -0.6%, Silver -1.2%, Oil +3.7%, Copper +0.1%, Iron Ore +6.1%, Corn +6.7%. 5y5y inflation swaps (EU +1bp at 2.17%, US flat at 2.64%, JP +7bps at 0.92%, and UK +13bps at 3.93%). 2yr Notes +15bps at 3.38% and 10yr Notes +5bps at 3.03%.

YTD Equity Indexes (high-to-low): Argentina +26.4% priced in US dollars (+69.4% priced in pesos), Venezuela +24.9% priced in US dollars (+63.9% priced in bolivar), Turkey +23.3% priced in dollars (+69.4% priced in lira), Chile +21% (+26.8%), UAE +18.7% (+18.7%), Brazil +17.2% (+7.1%), Saudi Arabia +11.6% (+11.6%), Indonesia +4.3% (+8.4%), Portugal +2.4% (+16.9%), Singapore +0.6% (+4%), Norway -0.4% (+10.1%), Israel -2.4% (+2.7%), India -5.7% (+1.2%), Thailand -8.6% (-0.8%), Mexico -8.9% (-11.3%), Canada -9% (-6.4%), Australia -9.4% (-4.6%), South Africa -10.4% (-5.3%), Malaysia -11% (-4.3%), Greece -12.3% (+0%), UK -12.7% (+0.6%), Philippines -13.7% (-5.2%), MSCI World -14.3% priced in dollars, HK -14.3% (-13.8%), S&P 500 -14.9%, Colombia -14.9% (-7.9%), Russell -15.4%, Japan -16.6% (-0.5%), China -17.8% (-11.1%), Denmark -17.8% (-6.7%), Spain -18.4% (-7.5%), Switzerland -19.5% (-15%), New Zealand -20.1% (-10.9%), NASDAQ -22.4%, Netherlands -22.5% (-11.6%), France -23.1% (-12.3%), Taiwan -23.2% (-16.1%), Belgium -25.5% (-15%), Czech Republic -25.8% (-16.7%), Korea -25.9% (-16.7%), Finland -26% (-16.1%), Russia -26.1% (-40.1%), Euro Stoxx 50 -26.5% (-16.2%), Ireland -27.5% (-17.2%), Germany -28% (-18.3%), Italy -29.4% (-19.9%), Sweden -31.2% (-19.2%), Hungary -32.5% (-14.5%), Austria -32.6% (-23.6%), Poland -35.5% (-24.6%).

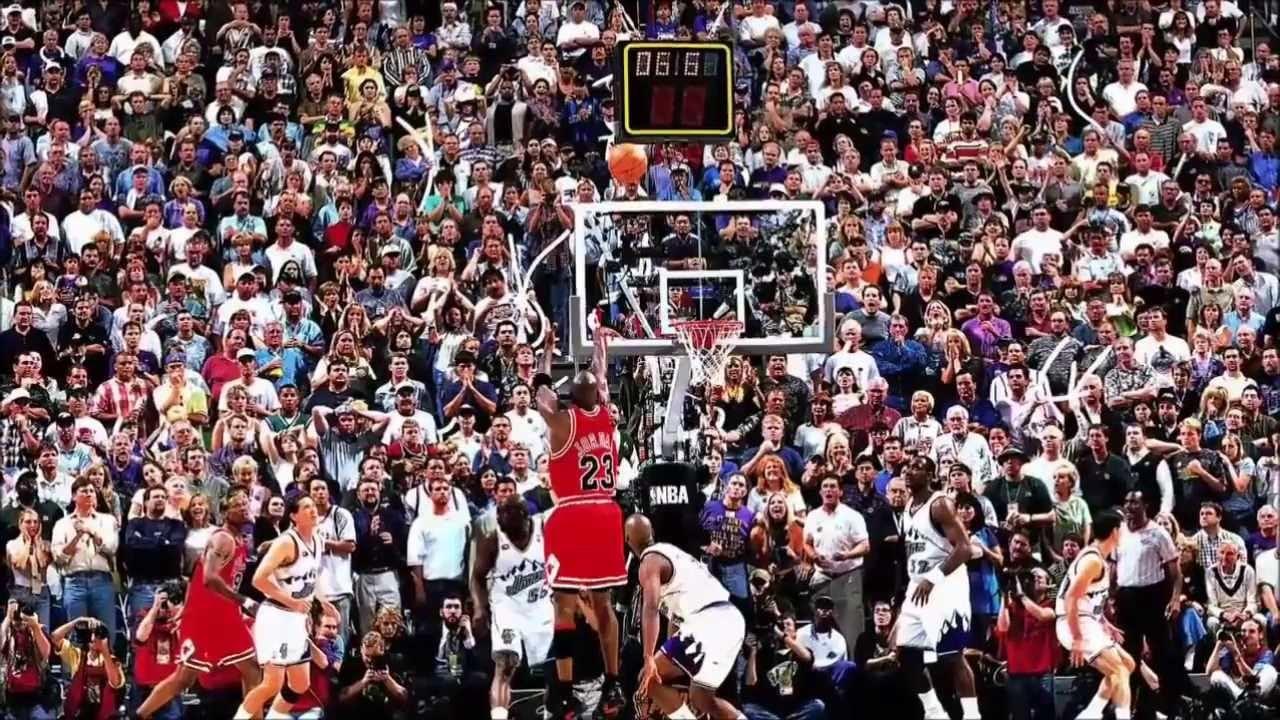

Anecdote (Feb 2013): “You know what impressed me most?” I asked Jackson, my 11yr-old, tears welling up in his eyes, unable to speak, as we sat in the car, looking across the empty field. “You played hard, kept your cool under pressure, and even in those couple games when you guys had no hope, you never lost yours.” He plays goalie. Very well. And got pulled up in post-season play to scrimmage with older kids, a few of whom hiss insults whenever he lets one slip by. “Look those cowards in the eye, hand them your gloves, tell them to either take the goal or shut up.” And Jackson nodded. “But I want you to secretly thank them, learn to smile at their insults, treat them as a gift,” I said, and he flashed me a puzzled look. “Because if you’re ever going to be great at this, or great at anything, you need to train to keep your cool, your calm, your confidence.” We discussed the importance of blocking out noise, of focusing on the process, and treating each moment in time as unique, as a new opportunity, unconnected to the previous failure or success. We talked about how that is an asset as valuable as ball skills – how it’s the difference between good and great. Jackson is a serious kid. Earnest. Literal. And he nodded, the tears now gone. Then I told my first-born the story about Michael. How he missed 9,000 shots in his career. Lost nearly 300 games. 26 times, Michael’s team entrusted him to take the game winning shot — and he missed. “Yup Jackson, that’s Jordan, and you know what he has to say about it,” I asked my wide-eyed boy. “I’ve failed over and over and over again in my life – and that is why I succeed.”

Good luck out there,

Eric Peters

Chief Investment Officer

One River Asset Management

Disclaimer: All characters and events contained herein are entirely fictional. Even those things that appear based on real people and actual events are products of the author’s imagination. Any similarity is merely coincidental. The numbers are unreliable. The statistics too. Consequently, this message does not contain any investment recommendation, advice, or solicitation of any sort for any product, fund or service. The views expressed are strictly those of the author, even if often times they are not actually views held by the author, or directly contradict those views genuinely held by the author. And the views may certainly differ from those of any firm or person that the author may advise, converse with, or otherwise be associated with. Lastly, any inappropriate language, innuendo or dark humor contained herein is not specifically intended to offend the reader. And besides, nothing could possibly be more offensive than the real-life actions of the inept policy makers, corrupt elected leaders and short, paranoid dictators who infest our little planet. Yet we suffer their indignities every day. Oh yeah, past performance is not indicative of future returns.